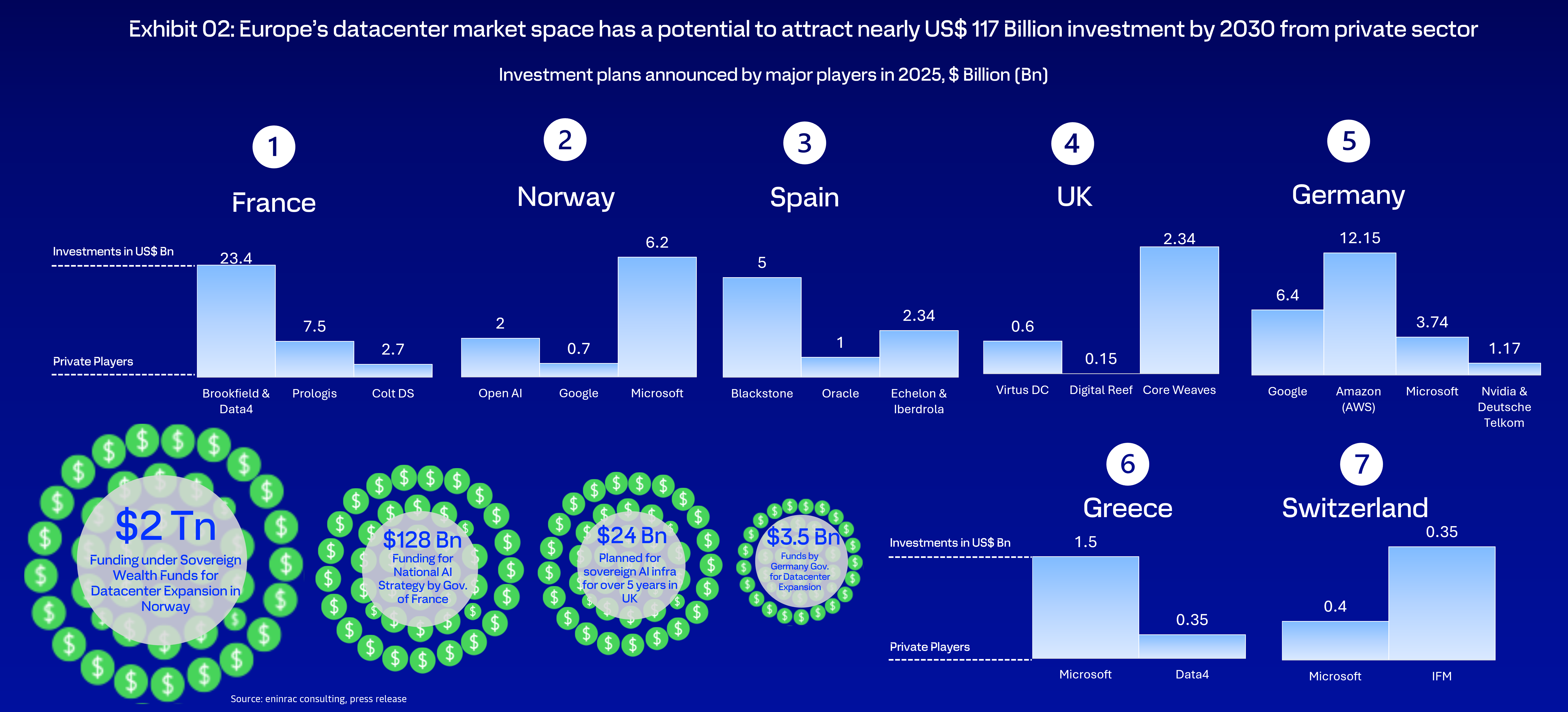

European Union to mobilize about US$ 234 Billion in AI- focused investments, intensifying business case for datacenter value chain

- What investment potential does Europe’s datacenter market holds for the value chain?

- Which are the emerging datacenter hubs in Europe offering high ROI?

- What policy, regulatory, and financing frameworks are enabling the scale-up?

- What opportunity does Europe’s datacenter market holds for the grid operators, BESS solution providers and power utilities ?

- What opportunity does Europe’s datacenter market holds for the EPC players?

Europe’s data center market presents a compelling, multi-year growth opportunity across the full value chain. Structural demand drivers—including accelerated AI adoption, continued cloud penetration, and enterprise-wide digital transformation—are underpinning robust capacity expansion. Learn about the opportunity hubs with Eninrac’s “Europe’s Datacentre Market Outlook: A Strategic Perspective to 2030”

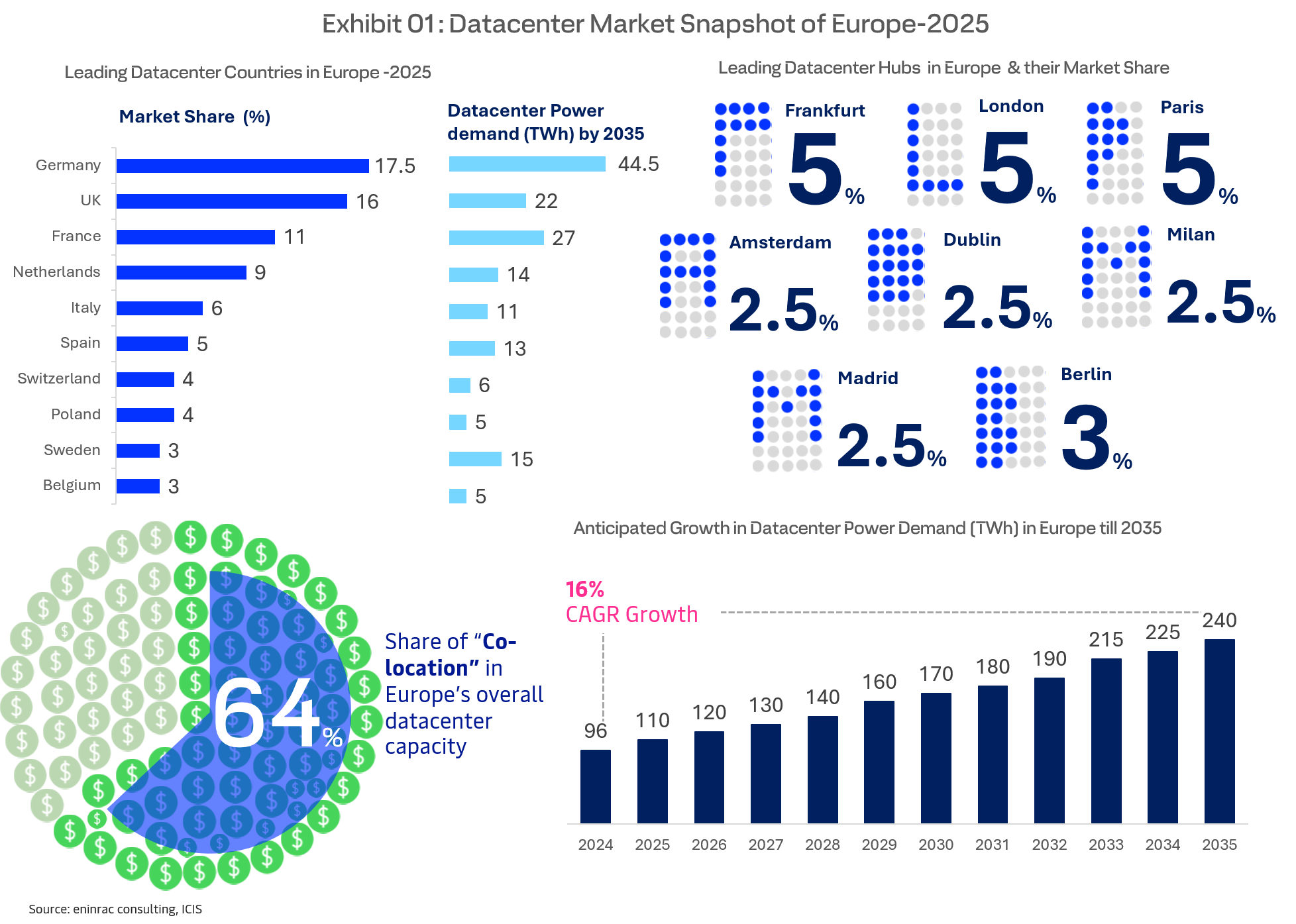

The European datacentre market was valued at approximately US$47 Billion in 2024 and is forecast to expand to nearly US$97 Billion by 2030, reflecting its central role in enabling Europe’s digital and AI-led growth agenda. The International Monetary Fund estimates that the accelerating adoption of artificial intelligence could lift global GDP growth by an additional 0.5 percentage points annually between 2025 and 2030, contingent upon the timely and large-scale deployment of datacentre infrastructure.

Across major European economies, datacentres have already emerged as a material driver of investment, economic output, and productivity. In the Netherlands, the datacentre and cloud ecosystem accounts for nearly 20% of total foreign direct investment, making it the single largest contributor to FDI inflows. In Germany, datacentres generated an estimated US$ 12.16 billion in direct and indirect GDP contribution in 2024, a figure projected to more than double to approximately US $ 27 Billion by 2029.

Comparable trends are evident in the Nordics, where Norway’s datacentre sector contributed an estimated US $ 281 Million to the economy in 2023, delivering higher economic value per unit of electricity consumed than traditional power-intensive industries such as chemicals manufacturing.

In the UK, the government estimates that accelerated AI adoption could improve national productivity by 1.5 percentage points annually, translating into incremental economic value of approximately US$ 64.3 Billion per year over the next decade. Similarly, the Irish government has underscored the “indispensable” role of datacentres in sustaining national economic competitiveness and societal advancement.

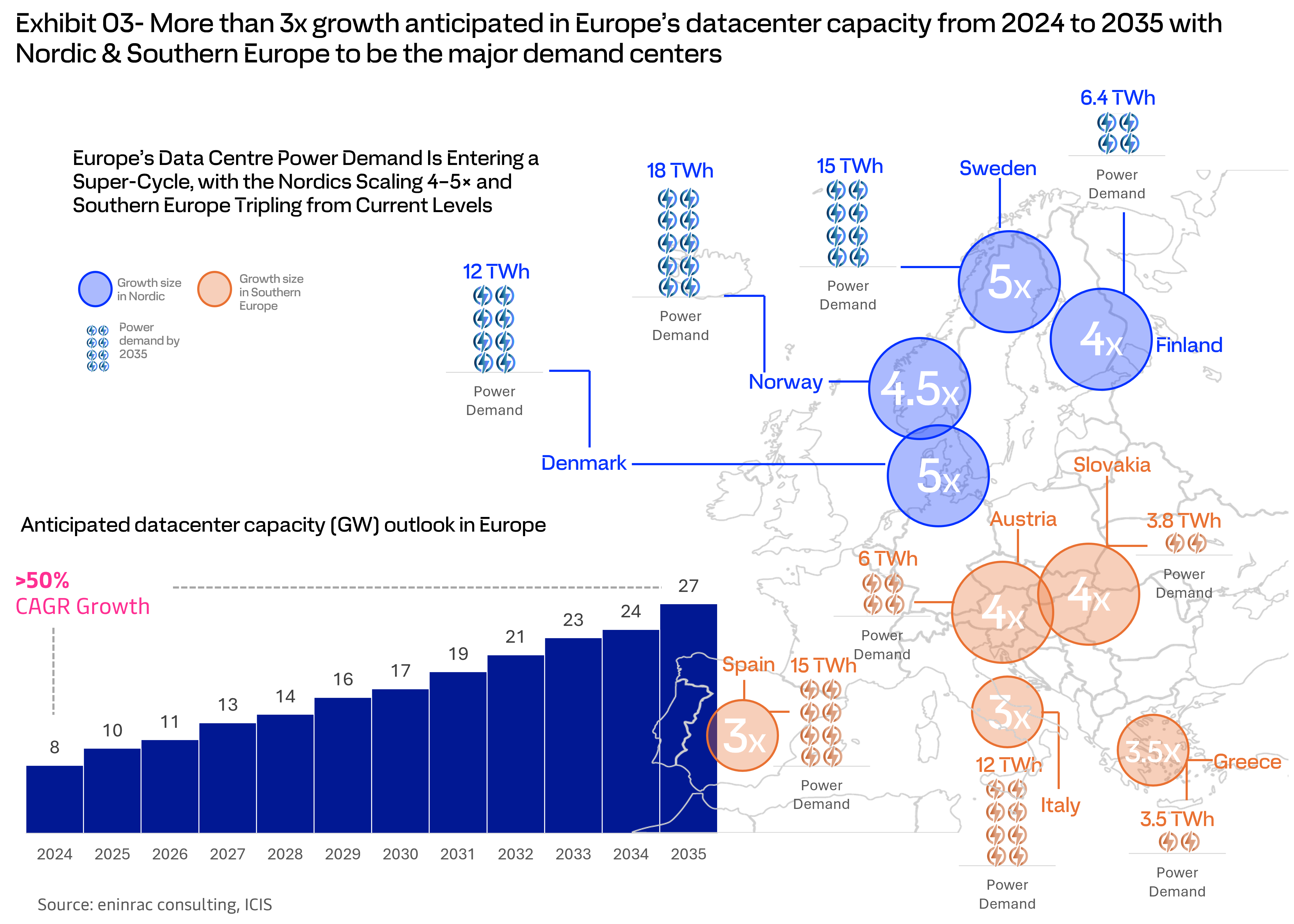

Green Datacenter Boom-Nordic & Southern Europe to hold Immense Revenue Potential for Grid Operators, RE Players & Power Utilities & Strategic Edge to the DC Players for Expansion

1. Nordic offer green baseload & heat monetization

The Nordic countries offer advantage in offering 40-50% low cost green power than rest of the Europe. Utilities can unlock long-tenure contracted revenues, capturing 20–30% margins through dedicated renewable offtake and district heating integration. The strategic edge for datacenter players would be bundle long-term PPAs with BESS and flexibility services to support AI-driven load volatility, targeting hyperscale expansions such as Eco Datacenter and Bulk Infrastructure’s 535+ MW Swedish pipeline

Case References-

-

Vattenfall in Sweden supplies 300 MW to Meta’s Gavle campus under a 15-year fixed hydro PPA (~€90/MWh), alongside €200M+ in waste-heat revenues supplying ~100,000 homes

-

atNorth in Finland integrates its 60 MW FIN04 facility with Fortum’s heating network, monetizing 70 MW of waste heat, generating ~€150M per decade, supported by EU incentives

2. Southern Europe countries offer value in hybrid solar + storage solutions and grid upgrades

Spain, Italy, and Portugal combine exceptional solar and thermal resources (500+ GW long-term potential) with available industrial land, positioning them as the next wave of datacentre hubs amid tightening FLAP-D capacity. Utilities and grid players can capture upto US$ 10 Billion in value through substations, microgrids, and grid reinforcement, with 25–35% margins across EPC and long-term O&M. The strategic edge for datacenter players in the southern Europe countries would be co-develop on-site or adjacent solar assets in Andalusia and Catalonia, while leveraging Portugal’s 2025 grid reforms to fast-track 110 kV connections for hyperscale campuses

3. Supporting cross regional demand response and flexibility

As AI workloads drive peak demand volatility, datacentre flexibility emerges as a monetizable system asset in both the regions, generating €75/MW/year for peak shaving, curtailment, and ancillary services. The regions offer strategic edge in positioning utilities as AI-era system orchestrators, combining flexibility markets, BESS, and dynamic tariffs to capture upside beyond traditional power sales

Case References-

-

Statnett in Norway integrates 100 MW of Green Mountain’s Oslo load into flexibility markets, generating ~US$ 49 Million annually

-

REE in Spain mirrors the model, enrolling 150 MW of AI-driven load from Oracle’s Madrid campuses

Key Signpost – What potential Europe holds for its datacenter market space ?

Europe’s Datacenter Growth Shifts Beyond the Core to the Secondary Markets

FLAP-D markets remain demand anchors but are increasingly constrained by power and land scarcity. This is accelerating expansion into secondary markets—such as Milan, Warsaw, Southern Europe, and the Nordics—where land is 20–30% cheaper and renewable energy access is stronger. Developers can capitalize on 855 MW+ of co-location growth in 2025 by delivering AI-ready, modular facilities with advanced cooling, as new entrants gain share from incumbents

Power Constraints as the Next Growth Catalyst for BESS Solutions

Power availability constraints are delaying approximately

40% of data center projects, unlocking $10B+ in opportunities across

renewable integration and energy infrastructure. Demand is accelerating for

hydropower, wind, and geothermal solutions—particularly in the Nordics—as

well as HVO fuel replacements and on-site substation deployments led by

players such as Schneider Electric, ABB, and Eaton. The rollout of 5G and

edge computing is further driving adoption of microgrids and battery

storage, supported by government tax incentives for green power procurement.

Turning Heat into Value: Data Center Cooling , to open the next frontier opportunity

AI workloads require high-density racks (50-100kW+), boosting liquid cooling (immersion, direct-to-chip) and advanced HVAC markets to $5B by 2030; modular containerized solutions from OHVcloud yield 20-30% efficiency gains

Potential for EPC & Real Estate Developers

The data center construction market is projected to reach approximately $35-40 billion by 2030, growing at an estimated 18.6% CAGR, with capital increasingly concentrated in large-scale wholesale campuses exceeding 100 MW

Demand for advanced datacenter infrastructure management (DCIM) & robust cybersecurity frameworks to get intensify

Telecom operators, including T-Mobile, are increasingly integrating with data centers to enable hybrid cloud solutions. Concurrently, significant AI infrastructure investments—such as Microsoft’s $ 5.6 B expansion in Italy and Brookfield-Data4’s $23.4 B program in France—are intensifying demand for advanced Data Center Infrastructure Management (DCIM) solutions and robust cybersecurity frameworks

High growth in network services

High‑capacity dark fibre, metro connectivity, and neutral interconnection platforms will grow faster than “plain” co-location, as AI, gaming, fintech and media push for low‑latency architectures.

Growth oriented market access, ecosystem & services

A wave of new brands (e.g., CloudHQ, Blue, Bluestar Datacenter, DATA CASTLE, Apto, EDGNEX) has already entered Europe, indicating a supportive ecosystem. Growing demand for outsourced maintenance, managed services, and green/ESG consulting also supports new operators and service firms, as enterprises and SMEs increasingly adopt co-location and cloud rather than building their own facilities