Exponential Growth Of Light Electric Vehicles In Latin America & The Caribbean (2020-2024)

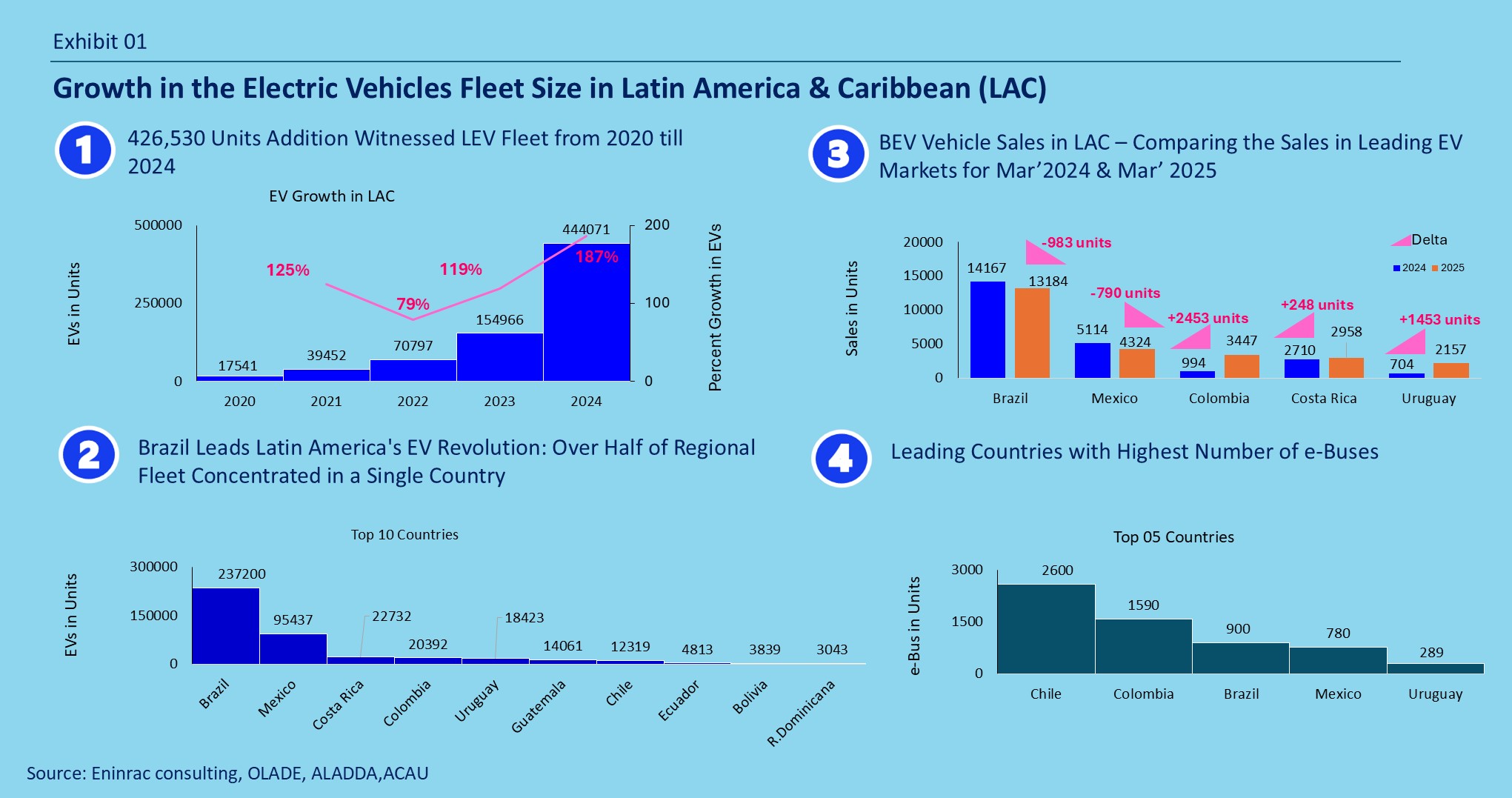

EV fleet size in Latin America & Caribbean increased from approx. 17,800 units in 2020 to 250,000 units in 2024.

Latin America's EV Revolution Accelerates: Light Fleet Grows 3X in 2024 as BEVs Outpace PHEVs

The Latin America and Caribbean region achieved a landmark in sustainable mobility in 2024, with its light electric

vehicle (EV) fleet multiplying nearly threefold within a single year. From 249,079 units in June to 444,071 by

December, this 78% surge witnessed over the past six months represents one of the world's fastest EV adoption curves

for the region.

This mid-year surge translated into an strannual growth rate of 187%, indicating that the number of

electric vehicles

in the region nearly tripled within a single year —a clear sign of market momentum and policy

traction toward

decarbonization and sustainable transport.

In global terms, by the end of 2024, LAC’s electric light vehicle fleet accounted for:

-

0.7% of the global electric vehicle stock, and

-

0.3% of the total light vehicle fleet within the LAC region.

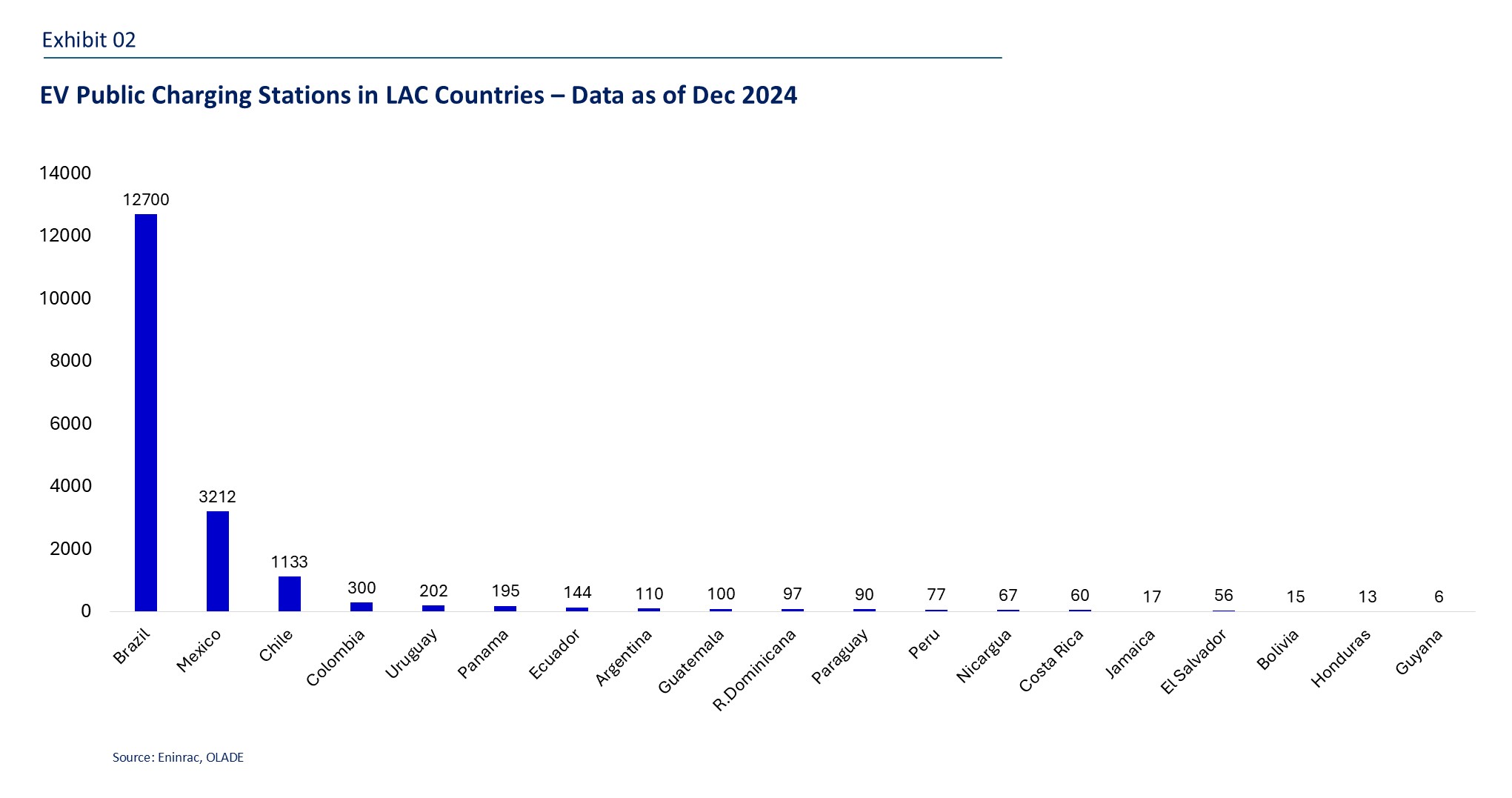

Charging Infrastructure Lagging Behind EV Growth in Latin America: 92% of Public Chargers Concentrated in Just Three Countries

As Latin America's electric vehicle (EV) fleet expands at an unprecedented pace, the region faces a critical challenge: building out a robust and equitable public charging infrastructure to match rising demand. By December 2024, the Latin America and Caribbean (LAC) region hosted a total of 18,594 public EV charging stations. However, this growth is heavily skewed, with 92% of all charging stations concentrated in just three countries—Brazil, Mexico, and Chile.

- Brazil alone commands the largest share, mirroring its dominance in EV adoption.

- Mexico and Chile follow as key infrastructure hubs, benefiting from early investment and national electrification strategies.

- In stark contrast, the remaining 24 LAC countries share a mere 8% of the total charging network, highlighting severe disparities in infrastructure deployment.

This imbalance underscores a pressing regional issue: while vehicle electrification is accelerating, charging accessibility remains disproportionately distributed, creating barriers to mass-market adoption in smaller or less developed markets. A deeper look reveals that:

- Charging station density per 1,000 EVs is significantly higher in Chile and Mexico than in regional peers.

- Urban-centric deployment is leaving peri-urban and rural corridors under-served, limiting intercity EV travel and logistics electrification.

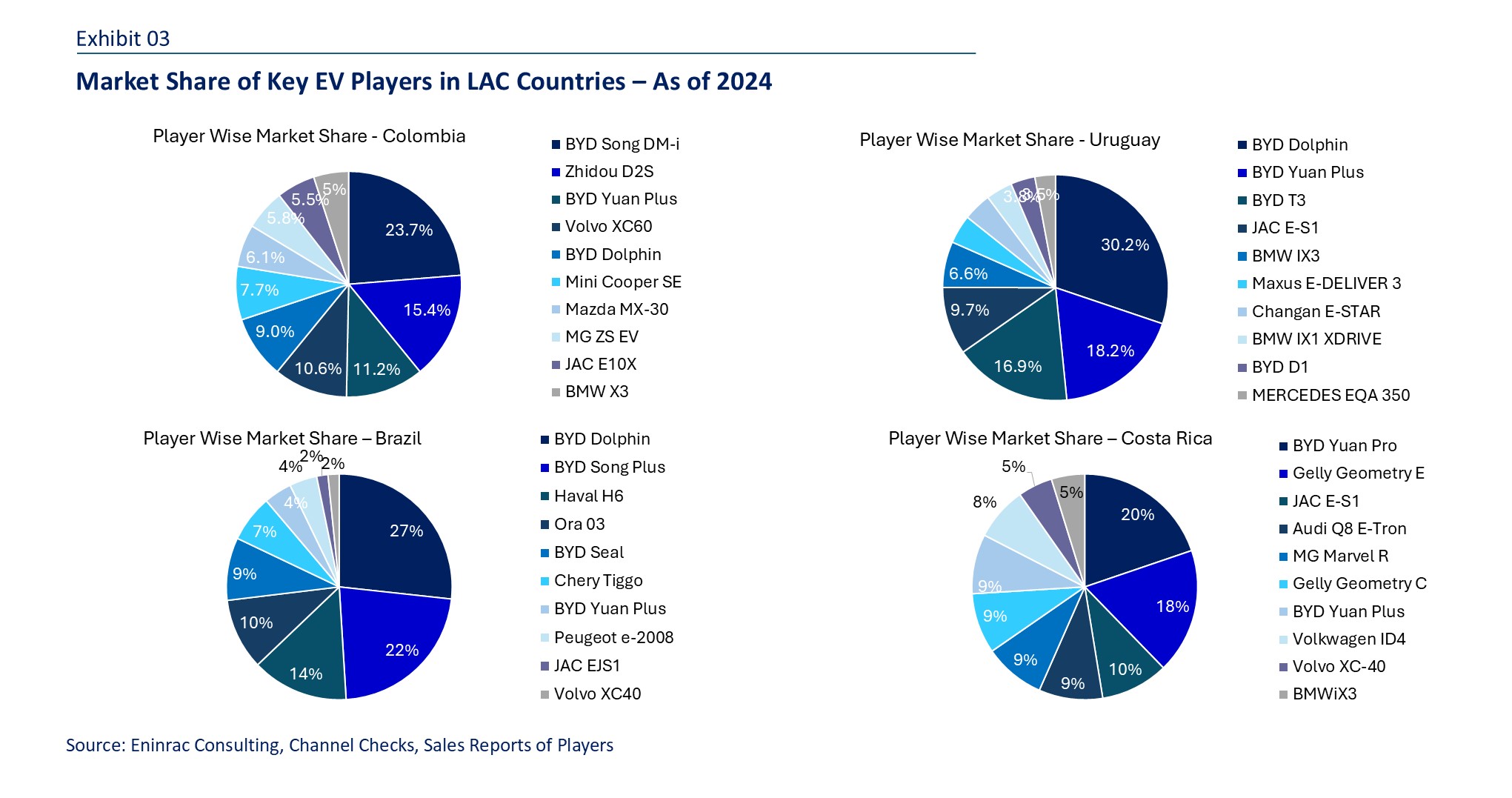

Latin America EV Market Share 2024: BYD Leads at 24% as Tesla & GM Battle for Dominance

The Latin American EV market remains highly competitive, with a mix of global automakers

- BYD Dolphin leads with ~27% market share, driven by aggressive pricing and local production in Brazil.

- Tesla follows at ~18.2%, buoyed by premium demand in Mexico and Chile.

- Chevrolet (GM) holds ~16.9%, leveraging its strong ICE-to-EV transition strategy.

- Volvo (11.2%) – Strong in Brazil & Argentina

- Nissan (10.6%) – Affordable models in Colombia & Peru

- Hyundai/Kia (9.7%) – Growing fast in Chile & Central America

- JAC Motors (7.7%) – Budget EVs in Mexico

- Regional Brands (Chery, Great Wall): Combined ~15%

- Brazil: BYD (62%), GWM (24%), Volvo (14%)

- Mexico: Tesla (30.2%), JAC (18%), Nissan (9%)

- Colombia: BYD (44%), BMW (12.7%), Zhidou (15.4%)

- Chile: Hyundai (22%), BYD (15.4%), Tesla (10%)

Colombia Commits to Zero-Emission Mobility by 2035: Policy-Driven Shift to Electric Vehicles Gains Momentum

Key Highlights and Insights- Landmark Policy Commitment: Colombia becomes the third Latin American country—after Chile and Uruguay—to sign the Zero Emission Vehicles (ZEV) Declaration, targeting 100% zero-emission car and van sales by 2035

- High-Impact Emissions Sector: The transport sector is Colombia’s largest source of GHG emissions, with road transport contributing nearly 78%, largely from Bogotá’s 1.8 million fossil fuel-powered vehicles

- National Legal Backbone for Climate Targets: Law 2169 underpins Colombia's climate action goals, targeting a 51% emission reduction by 2030 and net zero by 2050. Law 1964 (2019) became the country's first national electric mobility law, aligning with the Paris Agreement and offering incentives like tax breaks, parking benefits, and exemption from traffic restrictions for EV owners.

- Ambitious EV Deployment Target: Colombia plans to deploy 600,000 EVs by 2030, a massive leap from just 6,000 electric cars sold in 2023, representing a 100x growth target within 7 years.

- Leader in Electric Buses in the Americas: With 1,590 electric buses in operation, Colombia ranks second globally after China in e-bus fleet size. Law 1964 mandates 10% of urban bus sales to be zero-emission by 2025 and 100% by 2035—making it the first country in LAC with a binding e-bus procurement mandate. Bogotá is already implementing a 100% e-bus transition policy, setting a benchmark for other cities in the region.

- Charging Infrastructure Expansion: The government has legislated minimum thresholds for EV charging infrastructure—at least 5 fast chargers in special category cities and 20 in Bogotá by 2022. Public-private models are being encouraged, with power utilities like Enel X playing a key role—installing and operating 18 fast-charging stations in Bogotá to date

- Global Leadership Recognition: Colombia has also signed the Global MOU on Zero-Emission Medium- and Heavy-Duty Vehicles at COP28, signaling its commitment to decarbonizing freight and logistics

Read more EV insights, updates, and benchmarks at Einfews