INDIA UNION BUDGET 2025 -26

-

Investment in energy conservation schemes exceeds the previous year’s expenditure by 77.4% indicates a growing recognition of the importance of sustainability and energy efficiency. It reflects an increasing commitment to addressing energy consumption and environmental impact, as businesses or governments allocate more resources to advanced technologies, renewable energy, and energy-saving initiatives.

The significant cut down in the budget allocation for the transmission system in Arunachal Pradesh for 2025-2026 from 1315.01 Cr to 0.01 Cr could be attributed to several factors, such as the potential completion of key ongoing projects, enhancements in grid infrastructure and budgetary limitations due to other state priorities. This suggests that substantial investments in the transmission network have already been made, reducing the need for significant additional funding in the upcoming budget.

Hike in the budget for the Power System Development Fund indicates budgetary support for upgrading transmission lines, grid modernization, implementing smart grid initiatives, strengthening distribution network etc. Expenditure on scheme for power system development fund has seen a jump of 60% in budget 2025 – 2026 as compared to the budget 2024-2025. Transfer to Power System Development Fund has also seen the rise this year as compared to the last budget this aligns with the goal to strengthen the Power System of the country.

More investment in reform-linked distribution schemes indicates a focused effort to enhance the efficiency and reliability of power distribution systems. It reflects a commitment to modernizing infrastructure, improving service delivery, reducing losses, and ensuring better financial health of distribution utilities. These reforms often involve upgrading technology, improving metering and billing systems, and implementing performance-based incentives, all aimed at creating a more sustainable and transparent power distribution system. Such investments typically seek to reduce power outages, ensure equitable access, and foster long-term economic growth in the energy sector.

In budget 2025-2026 a hike of 27% is seen that shows the government focus on the betterment of the power sector by taking the needful reforms with the aim of high results.Central Assistance for Pakul Dul HEP under J and K PMDP 2015 as grant to CVPPPL and grant towards the cost of downstream projection work od Subansiri Lower Project (NHPC) have seen a significant decrease i.e. from 568.68 Cr to 300 Cr that accounts to 47.24% and from 51.98 Cr to 13 Cr that accounts to approx. 75% decline respectively.

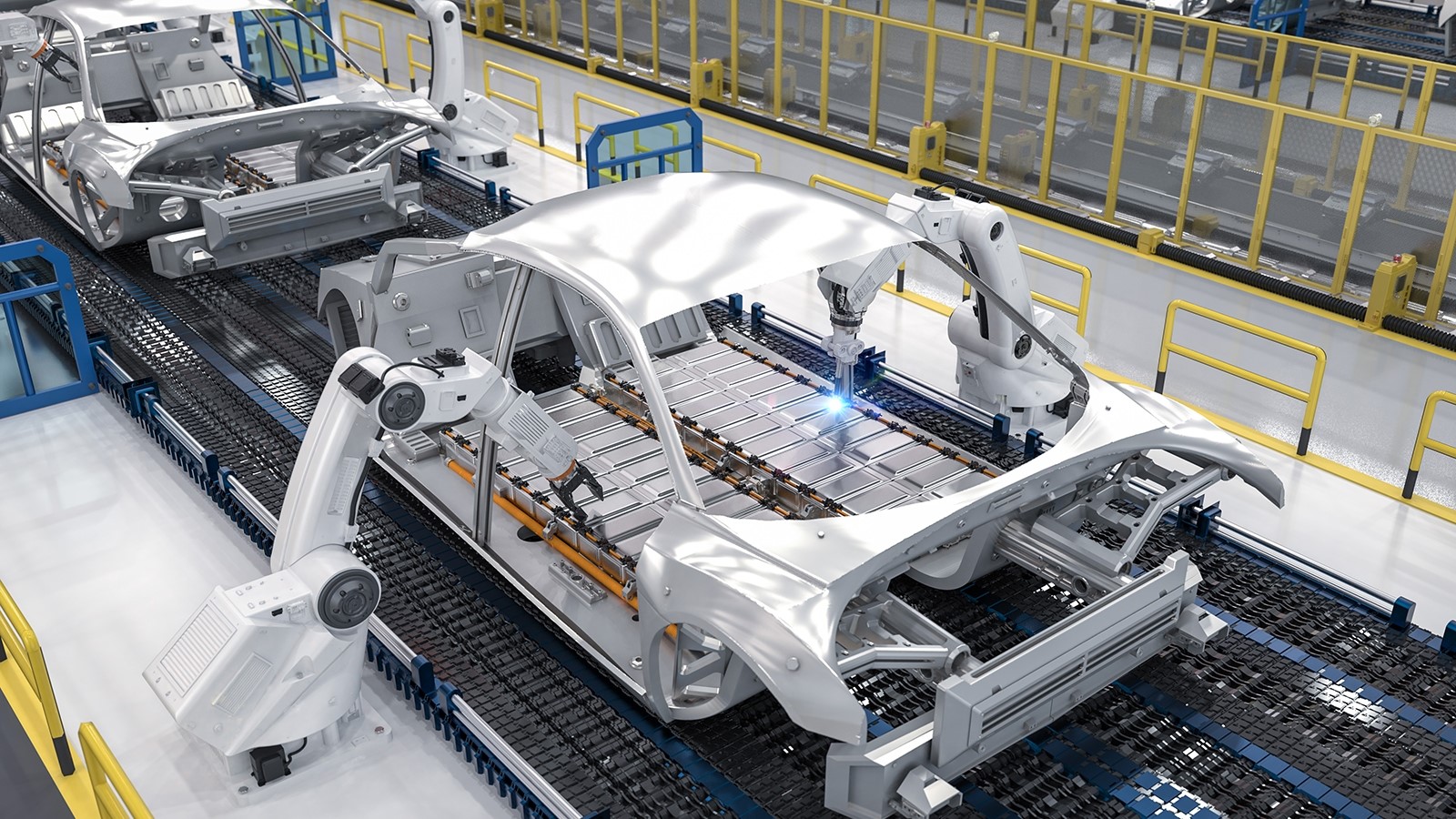

Significant decrease of expenditure fund is seen in other public sectors also i.e. Support for flood moderation storage – Hydro Electric project (33.4%), Payment pertaining to International Arbitration Case (58.3%) and Manufacturing Zones under Atmanirbar Bharat Package (75%).