Will Small Modular Reactors (SMRs) unlock large-scale market opportunities in India, or remain confined to strategic and remote-sector applications?

Why is a comprehensive assessment of SMR deployment clusters critical to unlocking India’s long-term market potential - spanning industrial, strategic, and remote applications and informing key stakeholders including public utilities, private developers, OEMs, and EPC partners?

India’s path to a low-carbon, energy-secure future is increasingly tied to

its ability to diversify beyond coal and integrate clean baseload options.

As of 2025, Small Modular Reactors (SMRs) have emerged as

a viable, scalable, and policy-aligned option to complement large reactors

and intermittent renewables, serving both grid and off-grid applications.

SMRs are poised to unlock a

potential $20 billion opportunity in India’s nuclear

segment over the next decade.

Dive deeper into the market potential, deployment clusters, and financial modeling of SMRs in India with Eninrac’s detailed report – Small Modular Reactors (SMRs) in India: Mapping the $20 Billion Market Opportunity.

Backed by indigenous R&D, global OEM interest,

and a push for industrial decarbonization, SMRs could play a transformative

role in India's energy mix. Offering passive safety features, modular

construction, and greater siting flexibility, SMRs are poised to fill a

critical gap in India’s clean energy transition by enabling faster,

decentralized nuclear deployment across industrial and remote regions.

SMRs would be critical for India Small Modular Reactors

(SMRs) offer India a transformative solution to meet its clean energy and

energy security goals. With their compact size, modular design, and enhanced

safety features, SMRs can be rapidly deployed in remote, island, and

industrial regions where large reactors are unfeasible. They address the

limitations of conventional nuclear plants, reducing capital intensity,

construction delays, and siting challenges - while providing stable,

low-carbon baseload power. As India accelerates its Net Zero trajectory,

SMRs emerge as a vital tool to decarbonize sectors, support grid resilience,

and localize nuclear manufacturing under “Make in India.”

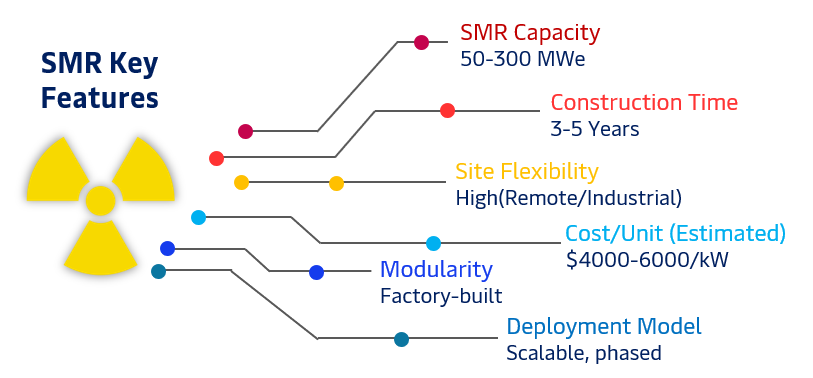

Understanding of Small Modular Reactors (SMRs)

This valuation reflects the rising global demand for clean, dispatchable,

and secure energy sources amid net-zero ambitions and the phase-down of

fossil fuels. Major economies, including the

United States, European Union, China, Canada, and Russia

are actively investing in SMR development as a strategic pillar to

decarbonize their power, industrial, and defense sectors.

With modularity, shorter build times, and passive safety features, SMRs are

poised to become a mainstream solution not just for energy security but also

for catalyzing nuclear manufacturing ecosystems globally. India's

participation in this market could unlock significant export potential,

technology collaborations, and domestic manufacturing growth under the “Make

in India” initiative.

How prepared is India for SMR deployment, and what is needed to build a robust domestic SMR ecosystem?

Assessing India's readiness for SMR deployment is pivotal for unlocking the full potential of nuclear energy in its clean energy transition. It provides strategic insights into regulatory preparedness, manufacturing capabilities, and the policy framework needed to support a scalable SMR ecosystem.

As India advances towards its Net Zero 2070 target, Small Modular Reactors (SMRs) emerge as a transformative option to deliver clean, reliable, and distributed power. Unlike traditional nuclear plants, SMRs offer shorter construction timelines, modular manufacturing, and deployment flexibility, ideal for industrial zones, remote regions, and defense applications.

A readiness assessment is critical to:

-

Gauge policy and regulatory alignment – Ensuring that Atomic Energy Act reforms and AERB licensing mechanisms are in place for private sector involvement

-

Identify supply chain and manufacturing strengths – Such as capabilities in heavy forgings, control systems, and reactor-grade materials

-

Enable localization and export potential – Positioning India as a competitive player in the global SMR market

-

Align financing and deployment models – To attract both public and private investments under scalable frameworks

Gap Analysis: India's Readiness for Small Modular Reactor (SMR) Deployment

India has made notable strides toward exploring SMR deployment, particularly through indigenous R&D and strategic MoUs with global technology providers. However, multiple gaps persist across regulatory, technological, financial, and infrastructural domains, hindering large-scale progress.

Policy & Regulatory Gaps: The regulatory ecosystem remains constrained by legacy frameworks such as the Atomic Energy Act, which limits private sector participation, and the Civil Liability for Nuclear Damage Act, especially Clause 17(b), which imposes significant liability risks on suppliers. These limitations deter foreign technology collaboration and private investment.

Technology Gaps: While the development of BARC’s i-SMR design and identification of pilot sites (e.g., Kaiga) show commitment, the absence of a mature prototype and clear licensing frameworks for foreign SMR technologies such as NuScale or GEH pose a barrier to timely deployment.

Manufacturing Ecosystem Gaps: India possesses a robust base for manufacturing structural components (e.g., L&T Hazira, BHEL), yet localization of advanced reactor modules and digital instrumentation & control systems remains limited. A strategic push for technology transfer and capacity enhancement is essential.

What are the key economic challenges for India to develop a robust SMR ecosystem?

High Upfront Capital Costs & Infrastructure Development

-

Challenge: SMRs, like large-scale nuclear projects, require significant capital investment in infrastructure before construction begins.

-

Diagram Insight: The phase labeled “Develop infrastructure and prepare for construction” involves substantial capital expenditure without immediate returns.

-

Implication: Raising initial capital is a barrier, particularly for new or smaller developers without deep financial backing.

2. Project Risk and Financing Difficulty

-

Challenge: Uncertainty during early phases leads to financing challenges.

-

Diagram Insight: “Project risks need to be identified and assessed” and “‘De-risking’ is key to access financing” emphasize the importance of addressing technical, regulatory, and market risks early on.

-

Implication: Without clear de-risking strategies (e.g., standardization, regulatory clarity, or government guarantees), SMRs struggle to attract private investment.

3. Construction Phase and Cost Overruns

-

Challenge: Long and expensive construction phases often lead to cost overruns and delays, even for modular technologies.

-

Diagram Insight: “Deliver the construction project as soon as possible and with the lowest costs” reflects the economic strain during the construction period, shown by the dip in cashflow.

-

Implication: Any delay increases the capital burden and pushes back revenue generation, which is particularly risky for first-of-a-kind (FOAK) SMRs.

4. Revenue Uncertainty and Market Access

-

Challenge: SMRs must secure stable, long-term revenue streams post-commissioning to recover costs and generate returns.

-

Diagram Insight: “Revenues need to be secured” and “Diversity sources of revenue” (from heat, power, flexibility) point to the need for market mechanisms that value the multi-functional output of SMRs.

-

Implication: Current electricity markets may not fully value the flexibility, reliability, or co-generation potential of SMRs, limiting their revenue potential.

5. High Recurring Operating Costs

-

Challenge: While SMRs are designed to be cheaper to operate than traditional reactors, they still incur significant operating, fuel, and maintenance costs.

-

Diagram Insight: “Keep operating, fuel, and other recurring costs as low as possible” emphasizes the need for cost-efficient designs and supply chains.

-

Implication: Without economies of scale, operating a fleet of SMRs may not achieve the projected cost reductions, especially for isolated or standalone units.

6. Asset Utilization and Longevity

-

Challenge: SMRs need to be in service for extended periods to justify initial investments.

-

Diagram Insight: “Maximize the use of generation assets over the longest possible period” emphasizes the importance of long operational life and high-capacity factors.

-

Implication: Early decommissioning or underutilization due to policy shifts or market changes can threaten project viability.