- What are the main regulatory barriers faced by RE and BESS projects in India to 2030?

- How do state differences affect PPA models and project bankability for RE & BESS markets?

- What are the key challenges related to grid access, open access, and dispatch for integrated RE–BESS projects?

- How are legal, tariff, and cross-subsidy rules evolving to affect project growth and investment by 2030?

Will India’s renewable energy and battery storage sector overcome regulatory complexities, PPA uncertainties, and grid integration challenges through policy reforms and streamlined frameworks to achieve sustainable scale-up by 2030, or will unresolved barriers and investor risks impede progress in the global clean energy transition?

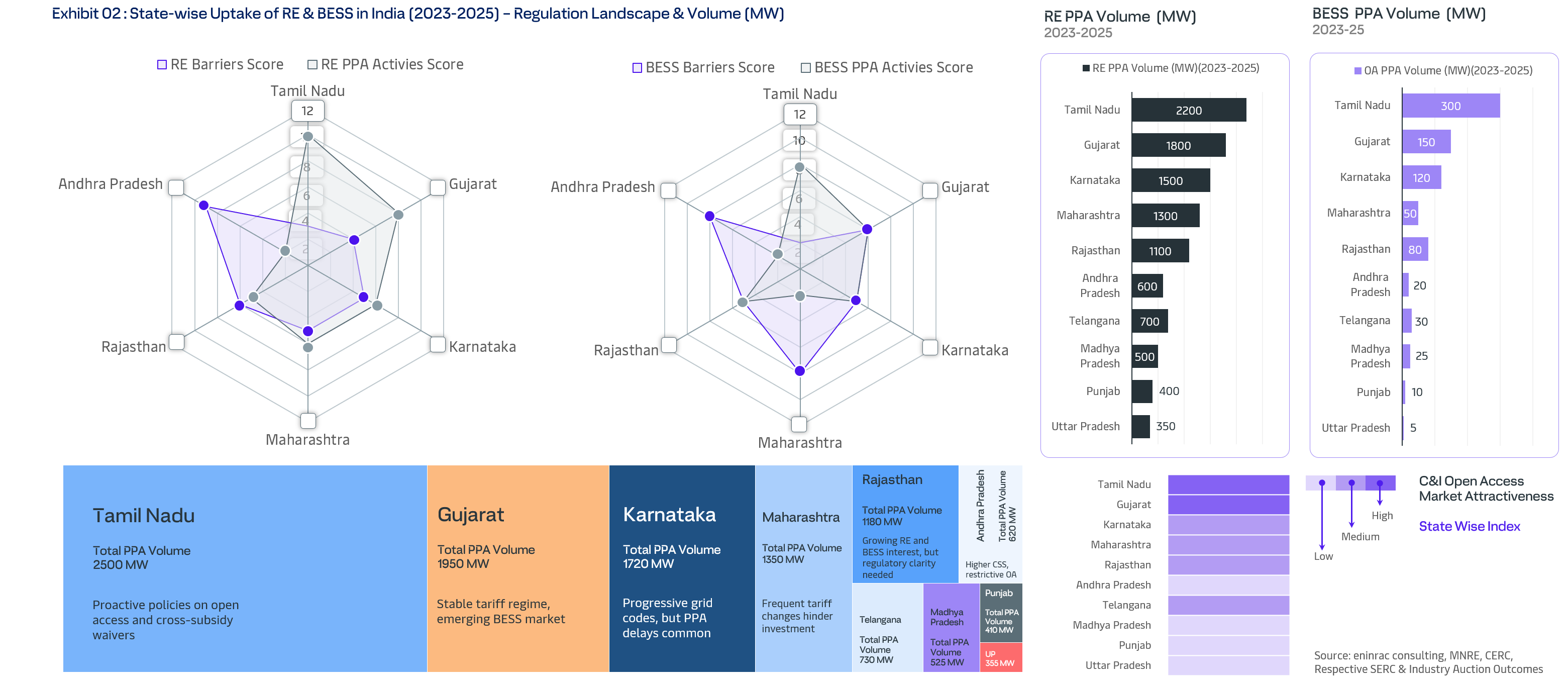

Renewable Energy Projects: Regulatory Overview and Market Dynamics

India’s Renewable Energy (RE) sector is witnessing robust growth, backed by government ambitions to reach 500 GW of non-fossil capacity by 2030. This growth trajectory is fueled by technological advancements, falling costs, and increasing demand from industrial and commercial (C&I) consumers leveraging open access mechanisms.

Despite this positive outlook, regulatory complexities at the state level continue to pose significant challenges that impact project bankability and execution timelines

- State-specific Variations: Regulations around open access, cross-subsidy surcharges, and tariff setting differ substantially among states. These variations influence the cost structure and financial attractiveness of projects, making some states more favorable than others for investors.

- PPA Approval Delays: Delays in Power Purchase Agreement (PPA) approvals and renegotiations create financial uncertainty. Combined with tariff revision uncertainties, these issues affect developer confidence and stall project progress.

- Inconsistent Regulatory Interpretation: Different interpretations of policies by state regulators lead to procedural delays and higher compliance costs, complicating project implementation.

- Financial Health of DISCOMs: The worsening financial condition of distribution companies (DISCOMs) leads to delays in signing PPAs and renegotiations, creating significant cash flow uncertainties for developers and stalling project progress.

States that have adopted investor-friendly policies, streamlined regulatory processes, and clear open access rules have witnessed higher PPA uptake, particularly in the C&I segment, propelling faster renewable energy adoption.

Why is a comprehensive analysis of India’s regulatory hurdles and PPA frameworks critical for unlocking sustainable growth in renewable energy and battery storage projects through 2030, addressing state-wise regulatory complexities, PPA barriers, grid integration challenges, and positioning India competitively in the global clean energy transition?

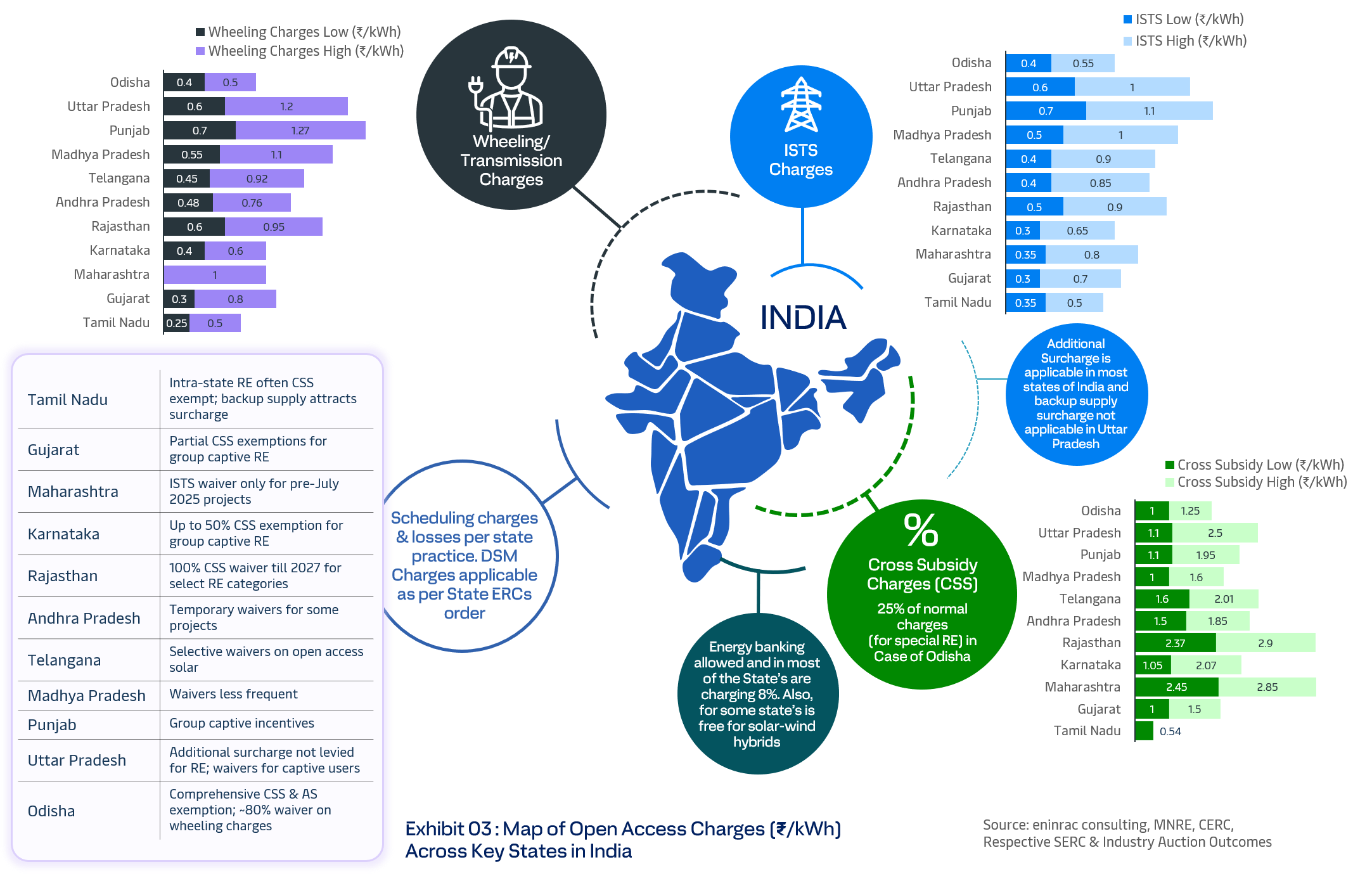

Inter-state Open Access Charges Across Top States in India & Evaluation of Inter & Intrastate OA Regulations

Interstate open access charges for renewable energy projects in India for FY 2025-26 consist of three key components: Inter-State Transmission System (ISTS) charges, state-level wheeling or transmission charges, and the Cross-Subsidy Surcharge (CSS). ISTS charges, which had been waived for most renewable projects until June 2025, are now uniformly applicable to new projects commissioned after this date, with rates ranging roughly between ₹0.30 to ₹1.10 per kWh depending on the state. State transmission and wheeling charges vary widely, generally falling between ₹0.25 and ₹1.27 per kWh, reflecting the cost to use the local grid infrastructure. Many states provide exemptions or discounts on these charges, particularly for renewable energy consumers and captive or group captive users, to promote clean energy adoption.

The CSS, designed to compensate utilities for revenue losses when consumers opt for open access power instead of traditional distribution, varies significantly by state. It ranges from as low as ₹0.54 per kWh in Tamil Nadu to between ₹2.37 and ₹2.90 per kWh in Rajasthan. States like Rajasthan also offer generous CSS waivers for renewable projects, sometimes up to 100% until 2027, while others such as Gujarat and Karnataka provide partial exemptions, especially for group captive consumers. Additional surcharges and electricity duties may also apply, influencing the overall cost structure for power consumers and developers. These charges, combined with evolving state and central regulations, define the financial landscape for interstate open access.

Given these variations, renewable energy developers and consumers must carefully assess state-specific tariffs and exemption policies when planning power procurement. Staying updated with the latest SERC and CERC notifications is critical since project-specific impacts can differ based on scale, consumption voltage, and contract terms. The landscape is becoming increasingly favorable for renewables as states adjust charges and exemptions to meet ambitious clean energy targets, but meticulous due diligence remains essential to fully capitalize on open access benefits and cost savings

India's leading states are making significant progress in Battery Energy Storage System (BESS) deployment and renewable energy integration. Gujarat leads with over 360 MW / 720 MWh of BESS capacity in standalone and hybrid projects, utilizing tenders focused on real-time control (RTC) and peak shaving. Rajasthan has a visionary 22.5 GW BESS target by 2030, supported by phase-wise rollouts of large renewable+BESS and RTC hybrid projects. Maharashtra aims for 1.1 GW of BESS capacity by 2026, backed by solar+BESS grid services pilots and viability gap funding schemes. Karnataka plans 3 GW of utility-scale BESS, emphasizing FTM hybrid tenders. Andhra Pradesh targets 14 GW of hybrid BESS by 2030, progressing through SECI and state-level auctions. Telangana is preparing a 3 GW pipeline, focusing on solar+BESS hybrid projects and new state tenders.

BTM & FTM Policy Landscaping in India

The Front-of-the-Meter (FTM) and Behind-the-Meter (BTM) policy maturity scores across Indian states reflect their current regulatory frameworks, market readiness, and innovation levels in energy storage integration with renewables.

1. Karnataka

Karnataka scores highly with 4.5 in FTM and 4.0 in BTM, driven by proactive policies, innovative pilot projects in BTM storage, and structured FTM auctions enabling renewables-plus-storage projects. This state is recognized for developing viable tariff mechanisms and efficient integration of grid-scale and consumer-level storage.

2. Gujarat

Gujarat leads the country with a perfect 5.0 FTM score and 4.5 BTM score, benefiting from clear, well-established policies and aggressive scaling of storage projects. The state enjoys successful grid participation models, high uptake of hybrid systems, and a supportive ecosystem for both grid-scale and behind-the-meter battery storage solutions

3. Maharashtra

Maharashtra shows robust FTM development (4.0) with growing BTM traction (3.5), using policy incentives to support solar parks and pilot battery storage contracts. Its significant industrial and commercial demand enables steady storage adoption, although BTM market evolution is still maturing.

4. Rajasthan

Rajasthan’s FTM and BTM scores (4.5 and 4.0) stem from enabling policies supporting hybrid renewables, generous incentives, and large-scale solar plus storage projects which provide economic dispatch and grid stability services. The state leverages its substantial renewable resource base with modern storage.

5. Tamil Nadu

Tamil Nadu mirrors Rajasthan’s strategy with a 4.5 FTM rating and a slightly lower 3.5 for BTM, reflecting clarity and progressive rollout of front-of-the-meter tenders and behind-the-meter pilot schemes. These policies facilitate RTM grid integration alongside consumer-level storage deployments in commercial sectors.

6. Andhra Pradesh & Telangana

Andhra Pradesh and Telangana rank moderately with emerging but evolving frameworks. Andhra Pradesh scores 3.5 on FTM with a lower 2.5 on BTM, reflecting recent regulatory and policy efforts but ongoing implementation challenges. Telangana, scoring 3.5 and 3.0 respectively, is still building regulatory clarity and pilot projects but shows promise as a growing storage market.

In summary, states with advanced policies demonstrate strong leadership in both grid-scale and behind-the-meter storage markets, integrating storage with renewables for grid flexibility and consumer benefits. Their scores signify regulatory maturity, financial incentives, and technology adoption accelerating India’s energy transition.

Key Signpost – Project delays from regulatory bottlenecks and underfunded DISCOMs threaten India’s renewable and storage targets. Urgent reforms are needed to unlock investment and market growth by 2030

Future-Ready, Transparent, and Investor-Focused – Market reforms and robust policy clarity are critical to unlock India’s renewable energy and battery storage growth, overcoming regulatory bottlenecks and PPA challenges for a resilient clean energy transition by 2030

Regulatory hurdles and delayed Power Purchase Agreements (PPAs) continue to challenge India’s renewable energy and battery storage market, impeding project execution and investor confidence. Addressing land acquisition, grid infrastructure, and financial health of DISCOMs with robust policy reforms and clear contract frameworks is crucial to unlock India’s clean energy goals and ensure a resilient market outlook by 2030.

For Renewable Energy Developer

- Optimizing Project Planning and Execution: Gaining in-depth knowledge of regulatory hurdles and PPA timelines helps in minimizing delays and cost overruns during project development.

- Enhancing PPA Negotiation Strategies: Insights into evolving contract structures and financial health of DISCOMs enable developers to structure stronger, bankable PPAs that reduce revenue risks.

- Strategic Market Positioning: Understanding the regulatory landscape and upcoming reforms allows developers to identify high-potential states and segments, improving investment decisions and competitive advantage.

For Battery Storage Providers

- Scaling Deployment with Regulatory Clarity: Clearer policies on storage ownership and grid services enable providers to expand projects and offer innovative energy solutions.

- Capturing Emerging Revenue Streams: Understanding market reforms helps battery providers tap into ancillary services, peak shaving, and grid balancing revenue opportunities.

- Reducing Investment Risks: Insights into PPA frameworks and financial health of off-takers allow better risk management and enhance bankability for storage projects.

For Power Utilities & DISCOMs

- Optimizing Power Procurement: Improved understanding of PPA structures and regulatory reforms helps utilities design flexible, cost-effective procurement strategies to integrate renewable and storage capacities efficiently.

- Enhancing Grid Stability and Efficiency: Insights into battery storage market and regulatory changes enable DISCOMs to leverage storage solutions for demand management, peak load reduction, and minimizing curtailment risks.

For Financial Institutions & Investors

- Risk Assessment and Mitigation: Detailed insights into regulatory hurdles and PPA risks enable better evaluation of project viability and risk mitigation strategies.

- Identifying High-Potential Investments: Understanding market trends and policy reforms helps investors target financially viable renewable and battery storage projects with strong growth prospects.

- Designing Tailored Financing Solutions: Insights into sector challenges allow development of innovative loan structures, credit enhancement, and blended finance models to support project bankability.