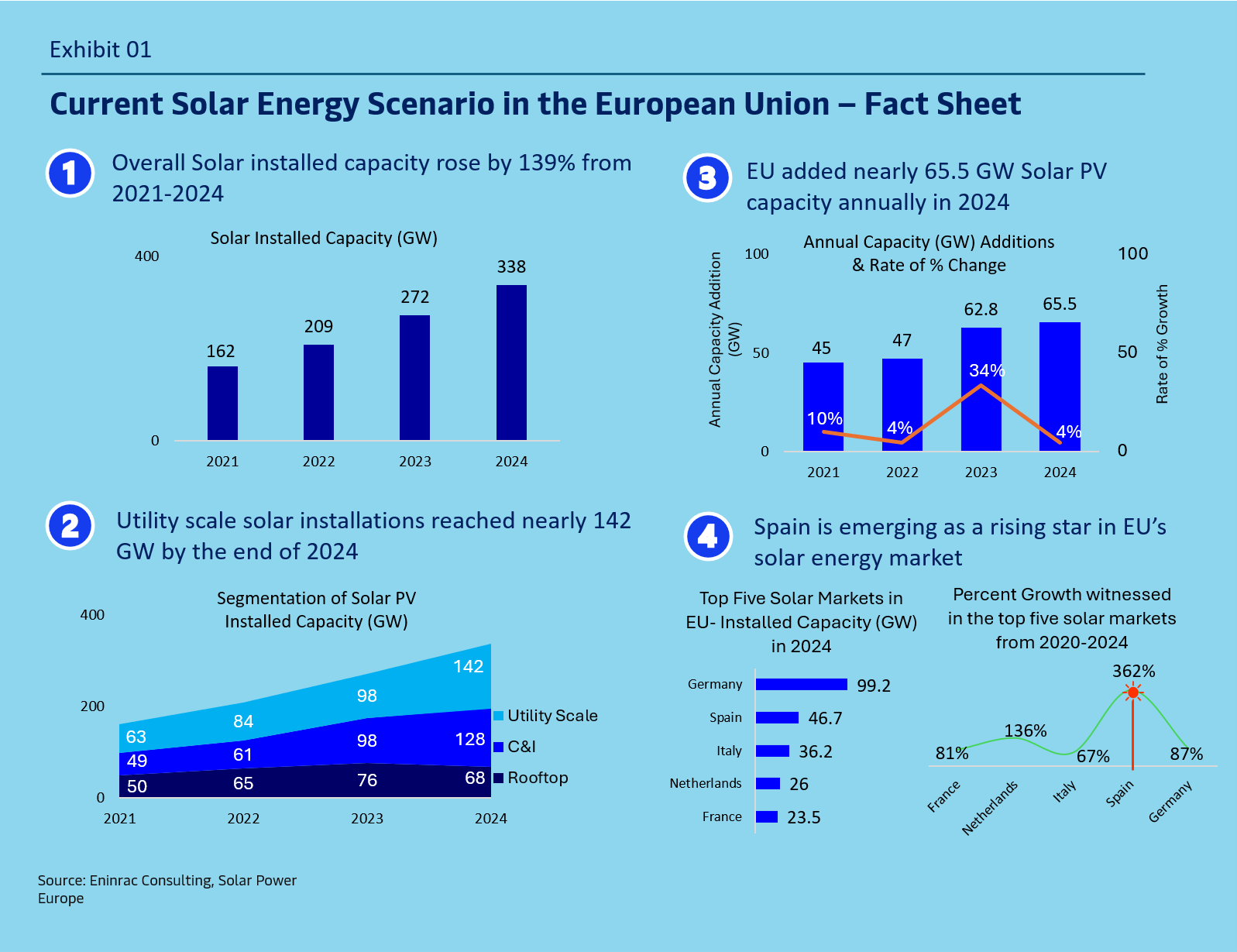

EU’s SOLAR PV INSTALLATIONS GROWTH DECLINED BY 92% IN 2024

The total solar PV installations in EU has reached 338 GW by end of 2024, marking a capacity addition of 66 GW approximately. However the region encountered a significant slow down in the growth of solar PV installations in 2024 as compared to 2023. The annual growth in the solar PV installations has slashed from 53% in 2023 to mere 4% in 2024, reflecting a fall of 92%. One of the major reason for this decline is the contracting residential and C&I solar rooftop market in the region. Since, 2021 the residential solar rooftop segment in the region has witnessed a decline in the installations, dropping from 31% to 20% by 2024. Hungary, Netherlands, Belgium are the markets that witnessed the maximum fall with installations declining by 74% , 65% and 60%. These sharp reductions were attributed primarily due to the phasing out of net-metering schemes. In the C&I solar rooftop segment – Austria, Sweden and Netherlands witnessed the maximum fall of 39%, 31% and 21%.

Growth in the Utility Scale Solar Segment

In Europe, utility-scale solar projects primarily encompass

ground-mounted installations, but also include large rooftop systems

with capacities exceeding 1 MW. While the small-scale rooftop solar

segment is experiencing a contraction in the region, the utility-scale

sector is witnessing significant growth, with a 45% increase in 2024

compared to 17% in 2023. Germany, Italy, and Spain are the leading

markets driving this expansion, with notable capacity additions of 5.9

GW, 2.6 GW, and 1.2 GW, respectively, reflecting growth rates of 29%,

123%, and 100% in their utility-scale solar capacities.

Track real-time solar project developments and market insights on Einfews – India’s leading energy & infrastructure intelligence platform.

Slump witnessed in the EU’s solar market can be attributed to-

-

1.Residential solar rooftop market in EU is experiencing a

slowdown.

As the sense of urgency to shield against high electricity prices during the energy crisis has faded away, several incentive schemes are being phased out, leading to a significant slowdown in the residential rooftop market. For instance in Germany, the EEG amendment freezes the reduction in feed-in tariffs until 2024, after which it will decrease by 1% every six months. France has also announced to slash the incentives for solar rooftop projects with a capacity for less than 500 KW from 1 Feb 2025. Netherlands would be phasing out the net metering scheme by 1 Jan 2027. From there on, the energy suppliers in Netherland will be able to determine how much money they want to pay for feed-in electricity by the SRT owners. It is possible that there will be a legally determined minimum price. Some energy suppliers like Eneco have already determined the fixed feed-in costs.

Exhibit 02

Revised Feed in tariffs in France for SRT (Feb-Jun2025)

S.No. Category (Aug–Oct’2024) (Feb–Jun 2025) Change 1 Solar (Baseload) 0.145 0.13 Fall of 0.015 €/kWh 2 Solar + Wind (Baseload) 0.14–0.155 0.11–0.13 Av. Fall of 0.03 €/kWh 3 Solar + Wind (Peak load) 0.165–0.175 0.135–0.145 Av. Fall of 0.03 €/kWh Exhibit 03

-

2. Low flexibility.

Grid congestion and lack of storage lead to a rise in negative electricity prices and higher curtailment rates, diminishing the financial appeal for solar investments in the utility scale solar PV projects. For example – Denmark based company Better Energy expects to postpone 3GW of upcoming solar projects in its Danish pipeline until after 2030 due to poor market signals, including negative electricity prices. It is pertinent to note that during 2024, the annual capital investments solar PV segment has declined by 13% as compared to 2023.

-

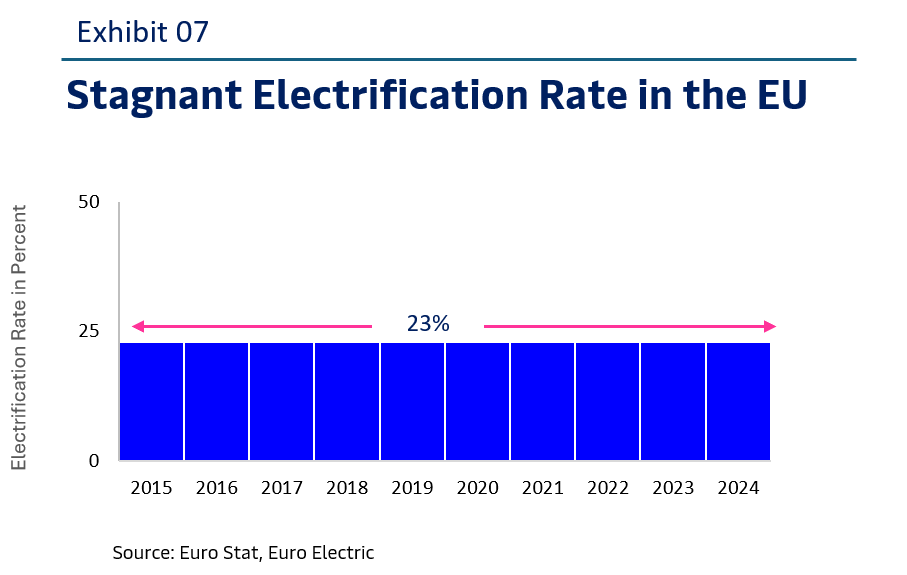

3. Stagnant Electrification Rate.

The electrification rate in the EU is stagnating since 2015. Heavy industry and evolving mobility trends needs to electrify faster to allow integration of more renewable electricity.

-

4. Permitting and land access issues persist,

remaining complex and time-consuming in several member & non member states. These challenges continue to delay project timelines, impeding growth and adding cost burdens. Typically, the permitting for renewable energy projects in the EU takes 7-10 years in many cases and in some exceeding 10 years also. One of the major bottleneck faced by many EU countries is awaiting the grid connections. The rapid expansion of renewables has outpaced the electricity grid's capacity, depleting infrastructure reserves and straining the ability to integrate them. The existing regulatory framework has contributed to this, as well. There are now prolonged wait times experienced by developers in Spain, Germany, Italy and other EU member countries for EPC services, with some delays even extending to 12-18 months due to high demand.

Additionally, in UK many solar farms and rooftop systems on warehouses face grid connection delays of 10 to 15 years, posing a major obstacle to expanding solar capacity. This stands in stark contrast to the UK’s target of increasing solar power fivefold to 70 GW by 2035, while only around 15 GW of grid connection capacity is currently available.