Co-locating Batteries In India: A Strategic Analysis And Value-maximizing Model

India now recognizes co-located Battery Energy Storage Systems (BESS) as both an economic and a grid

necessity. This shift is driven by the nation's rising renewable energy targets and increasing grid

congestion, which are pushing faster adoption.

Among the various models, hybrid solar-plus-storage

plants

are creating the strongest value proposition. By enabling energy shifting and providing critical peak

support, these installations significantly improve project returns while simultaneously enhancing the

reliability of grid supply.

Executive Summary

Co-locating battery energy storage systems (BESS) with existing or new generation assets, particularly solar,

is not just a viable strategy in India it is becoming an economic and grid-stability imperative. Driven by

aggressive renewable energy targets, grid congestion, and specific policy signals, BESS can unlock

significant value.

The model that adds the most value in the current Indian context is the Hybrid Solar

+

Storage Power Plant, optimized for Energy Shifting and Peak Power Management. This model directly addresses

the "duck curve" challenge, turns curtailed energy into revenue, and provides reliable, high-value power to

the grid.

The Indian Energy Context: The “Why” for Co-location

India has set an ambitious target of 500 GW of non-fossil fuel capacity by 2030, with solar energy as the cornerstone. This rapid transition creates unique challenges that BESS is uniquely positioned to solve:

-

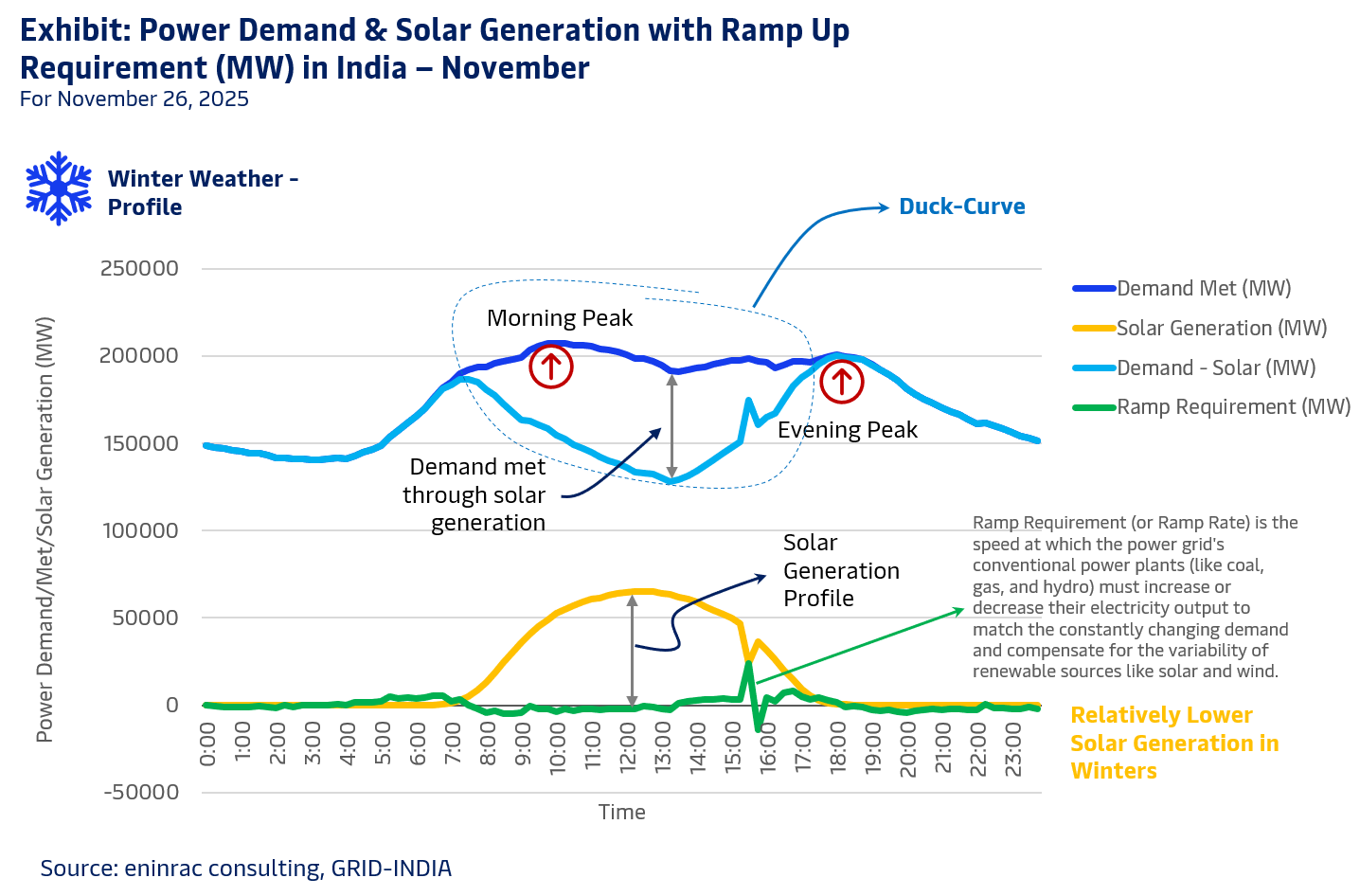

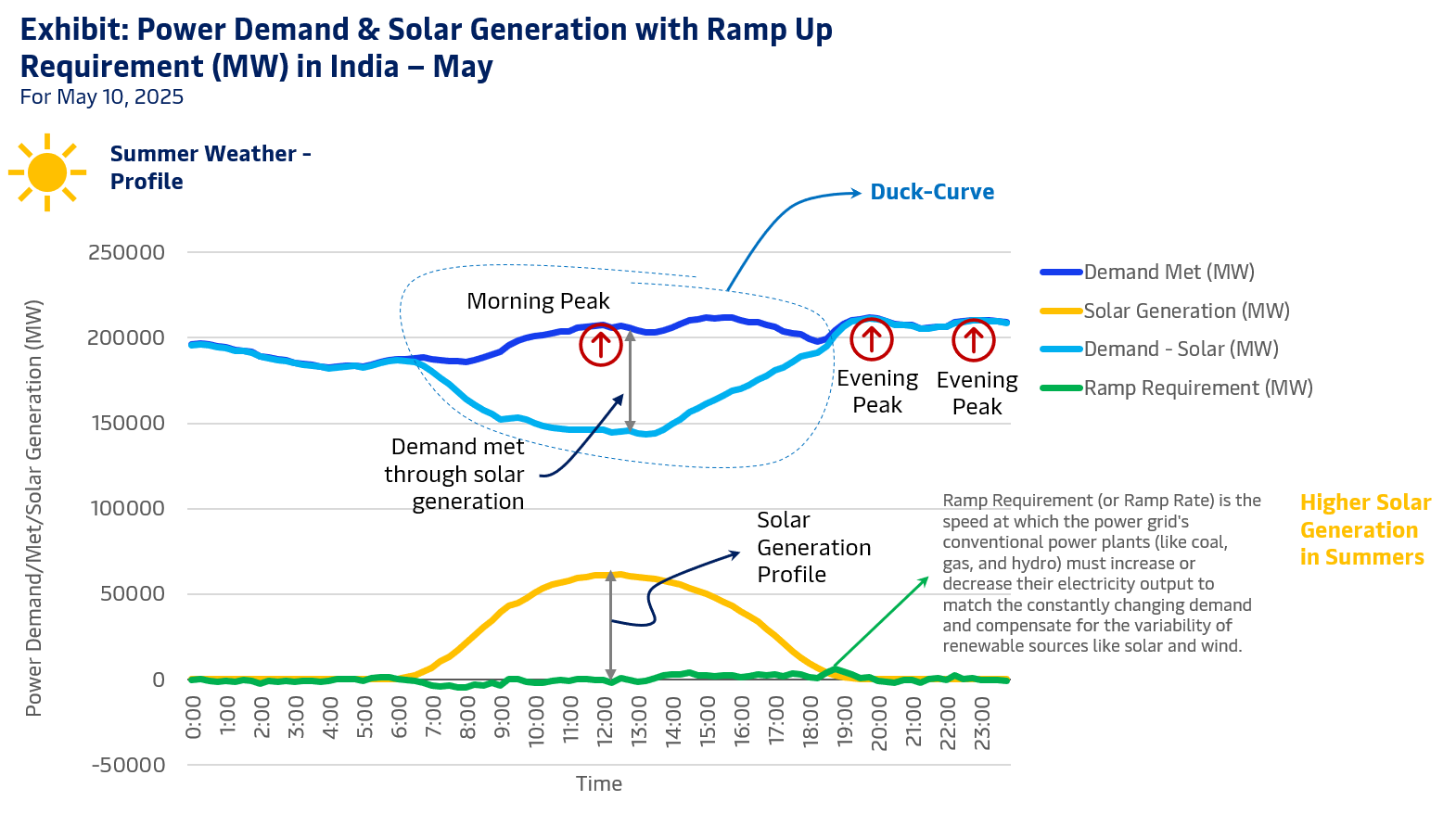

The "Duck Curve" Problem: Daytime solar generation creates a massive surge, which plummets in the evening, requiring a rapid ramp-up from conventional power plants. BESS can store midday solar energy and discharge it during the steep evening ramp, flattening the curve.

Source: Eninrac Consulting, GRID-INDIA

-

Renewable Energy Curtailment: As solar penetration increases, grid congestion during peak generation hours leads to curtailment (wasting of solar power). BESS can capture this "clipped" energy.

-

High Evening Peak Demand: India's peak electricity demand occurs between 6:00 PM and 11:00 PM, precisely when solar generation is zero. This creates a high-value window for discharged power.

-

Policy Support: The government has launched the Viability Gap Funding (VGF) scheme for Battery Energy Storage Systems (BESS), targeting 4,000 MWh of capacity. This directly de-risks and subsidizes initial projects. Additionally, various state-level tenders for "round-the-clock" (RTC) power mandate storage integration.

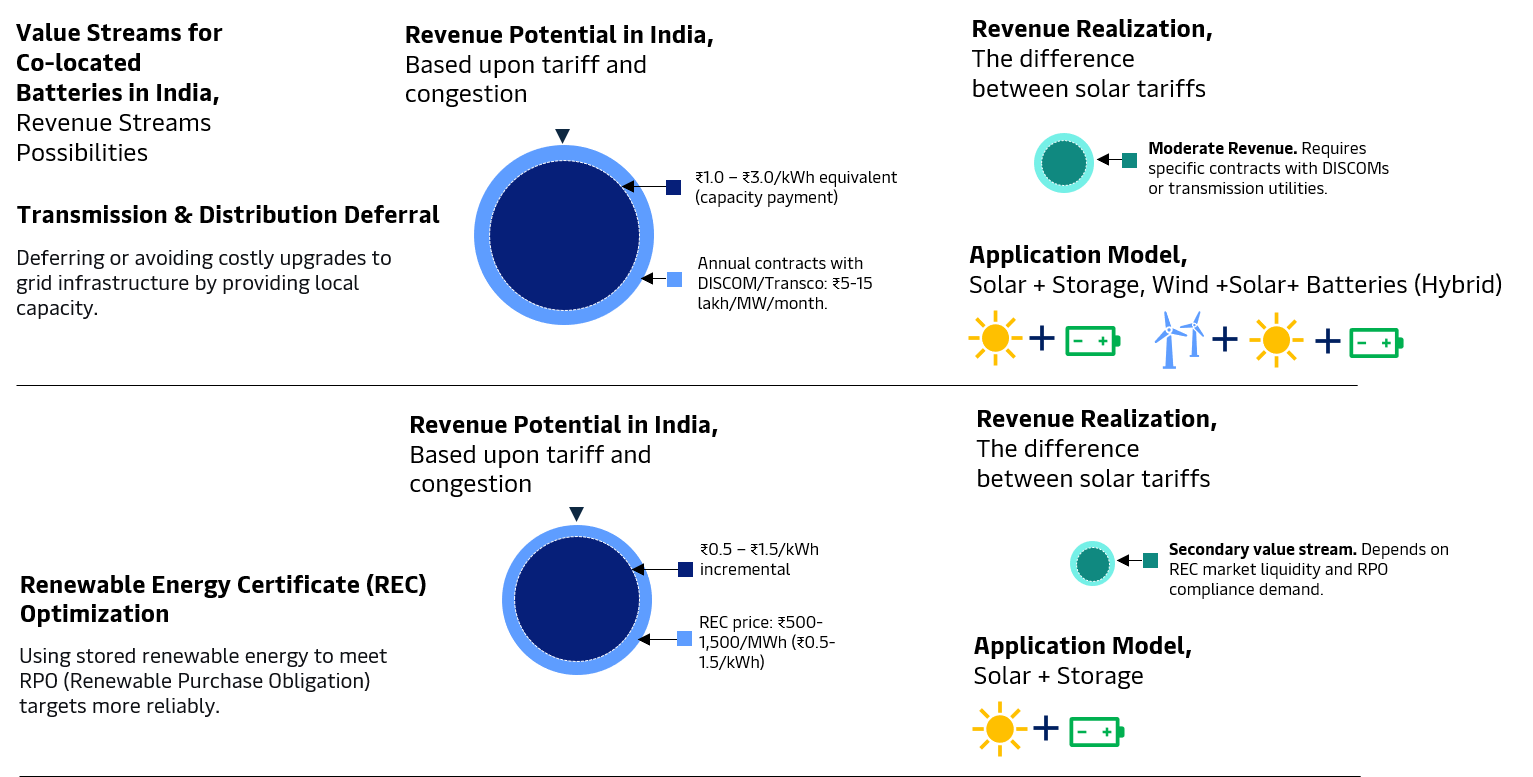

Value Streams for Co-located Batteries in India

Co located storage creates a unified revenue stack for developers and consumers. It supports energy shifting,

peak supply, RTC delivery and curtailment reduction. It also opens new income from ancillary services,

network deferral and REC optimization.

Developers raise asset value through multiple contracted and

merchant

streams. Consumers and utilities gain reliable clean power with better cost control. This combination

strengthens project viability in India’s changing power market.

-

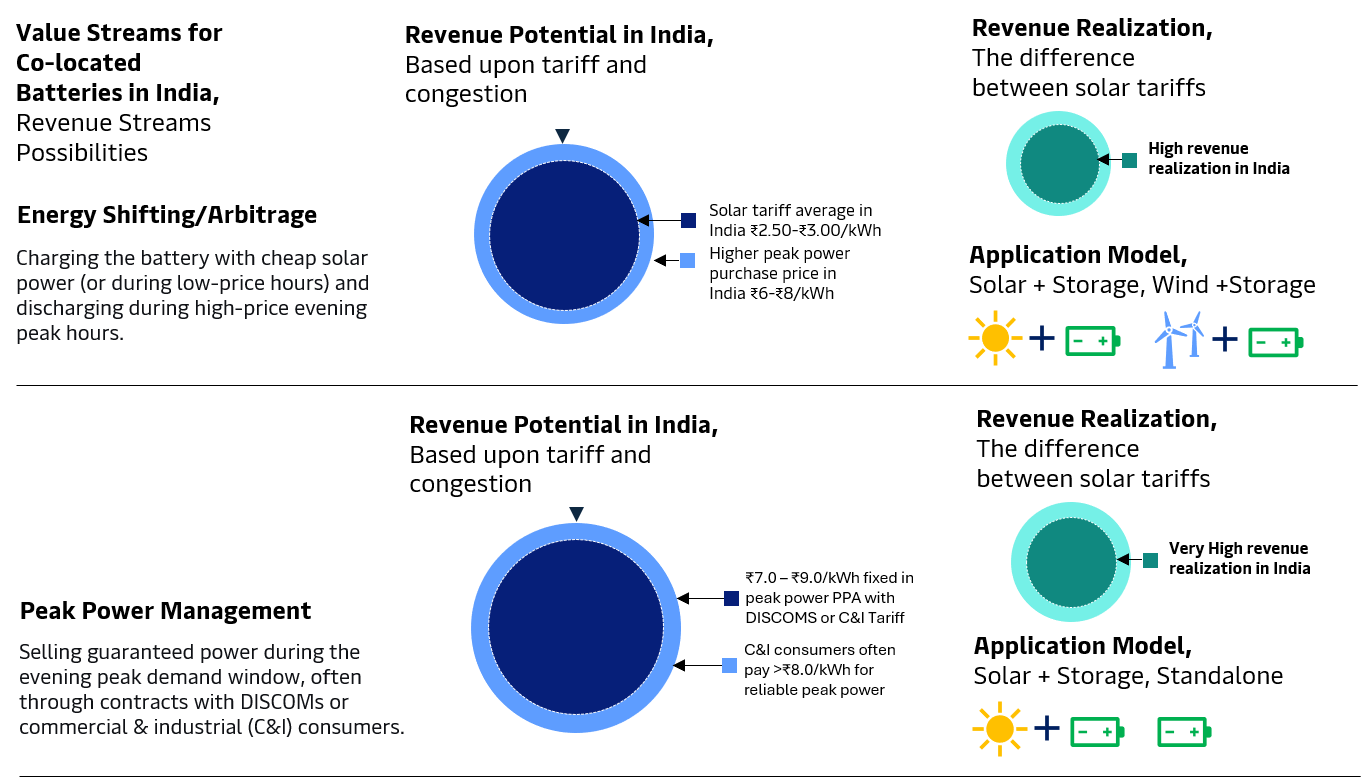

Energy shifting creates a clear price spread for both developers and consumers. Developers charge batteries during low-cost solar hours at ₹2.5 to 3 rupees per kWh. They discharge during evening peaks when prices reach ₹6 to 8/kWh. Consumers receive cheaper peak power and developers secure higher margins.

-

Peak power management unlocks premium tariffs. Developers commit firm evening supply to DISCOMs and C&I buyers. Consumers gain reliable peak power at contracted rates. Developers benefit from strong tariff premiums over base load supply.

Source: eninrac consulting, eninrac analysis

-

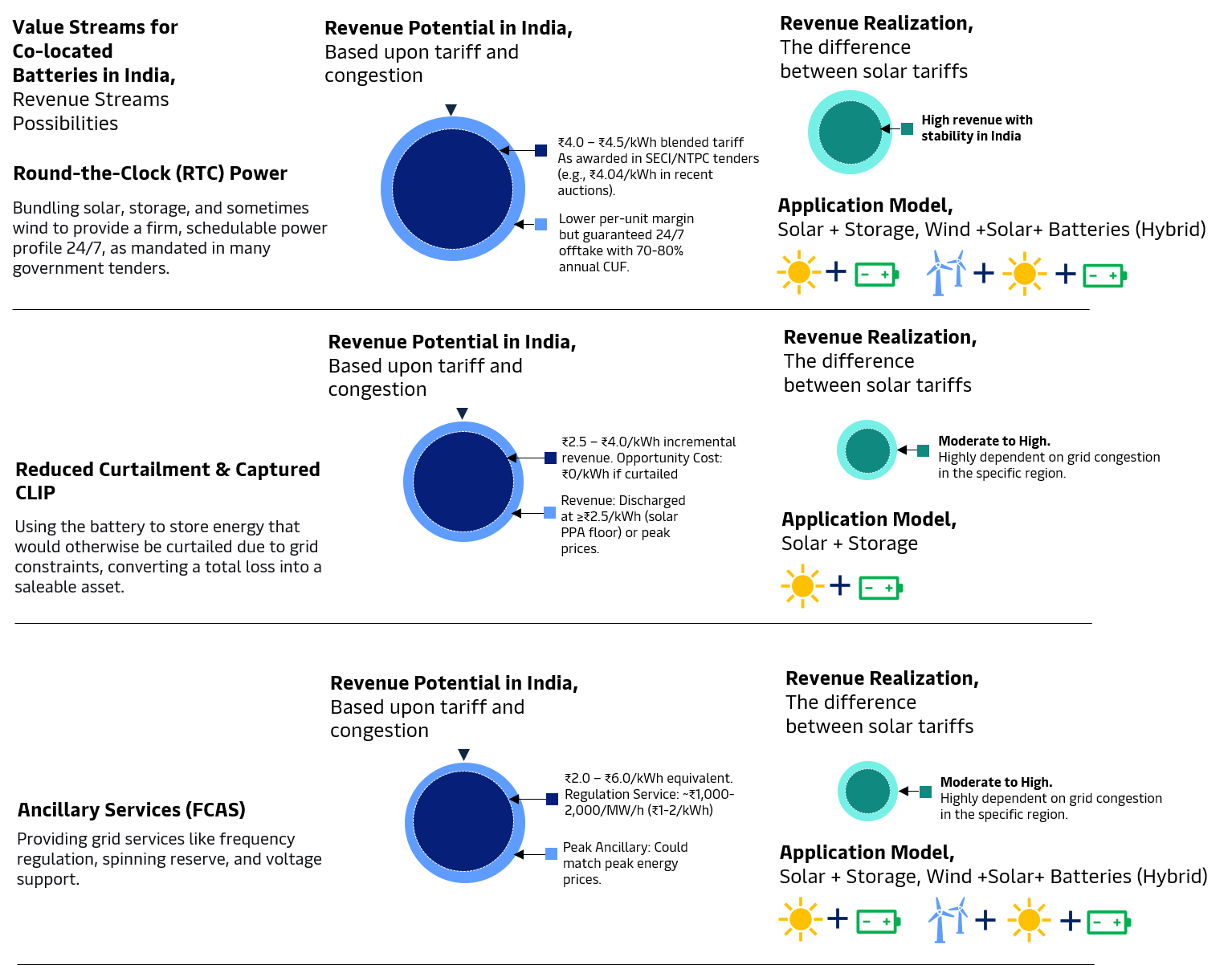

Round the clock delivery offers firm energy through solar, storage and wind portfolios. Developers provide schedulable power for 24 by 7 demand. Consumers obtain predictable supply at fixed tariffs that support long term planning. Developers secure stable revenue with reduced variability.

Source: Eninrac consulting, Eninrac analysis

-

Curtailment reduction turns constrained solar output into additional sales. Developers store energy during congestion. They release it when the grid allows. Consumers receive more consistent clean power and developers raise asset utilization.

-

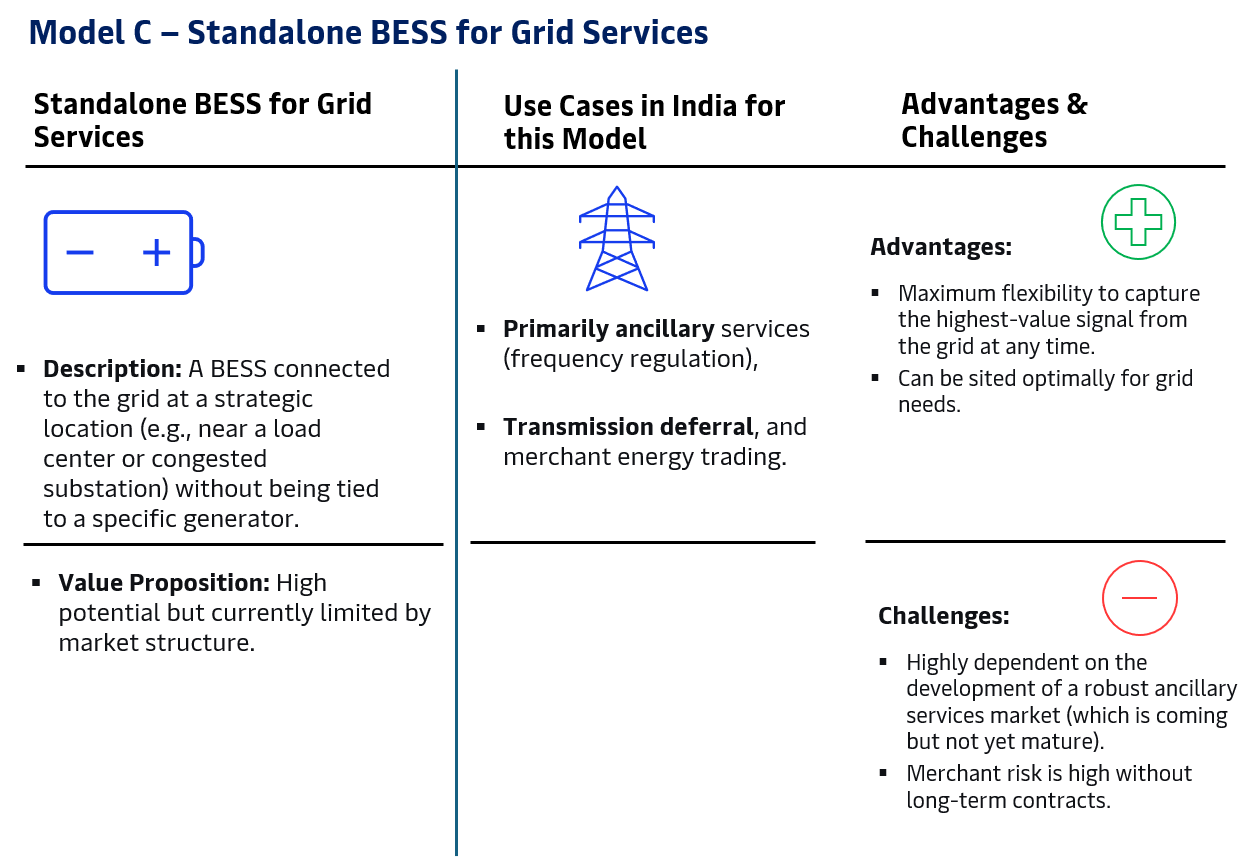

Ancillary services create a new market for fast grid response. Developers supply frequency regulation, spinning reserve and voltage support. Consumers and grid operators gain better stability as renewable share grows. Developers access an emerging revenue stream across all storage models.

-

T and D deferral offers targeted local capacity. Developers install storage in stressed areas that face peak congestion. Utilities avoid immediate network upgrades. Consumers experience better reliability and developers earn contracted payments for location specific support.

-

REC optimization improves compliance outcomes. Developers store renewable energy and discharge during obligated periods. Consumers with RPO requirements reduce REC shortfall risk. Developers gain steady value from environmental attributes tied to solar plus storage systems

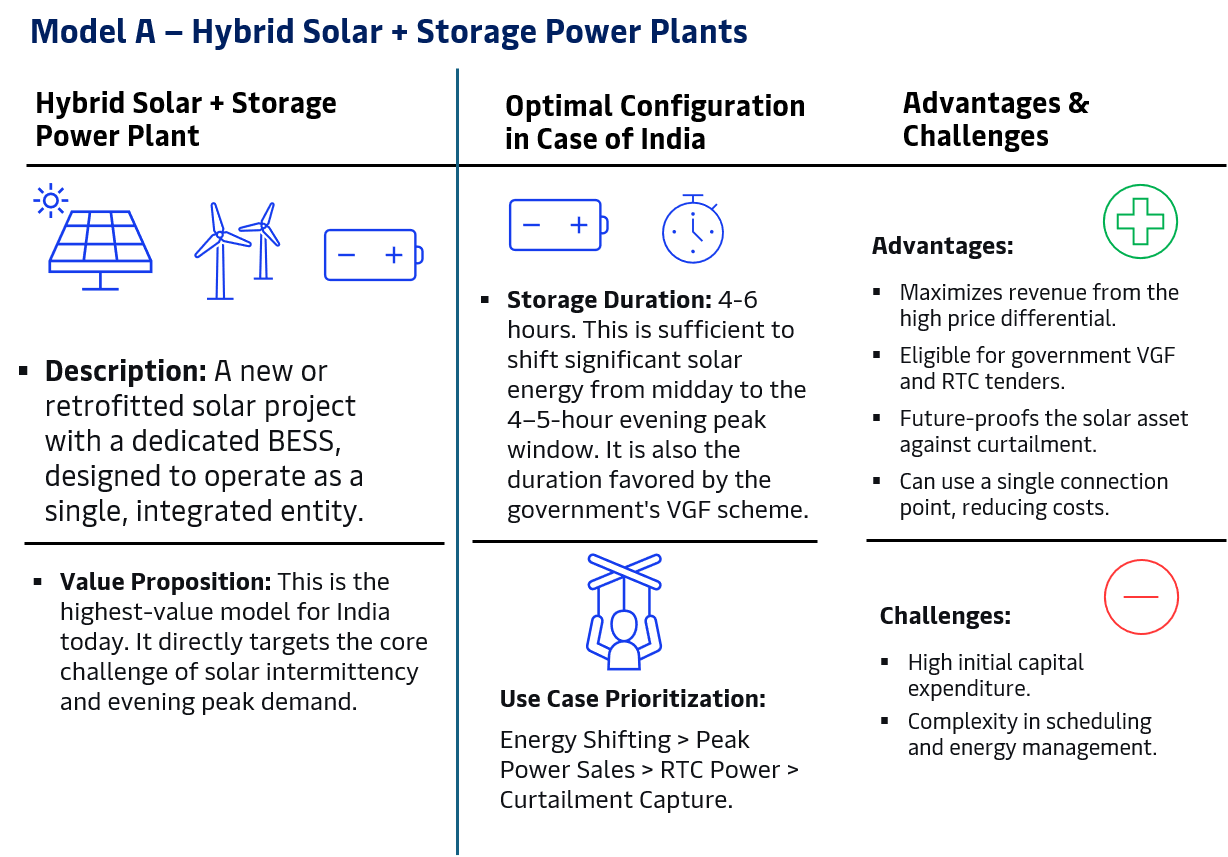

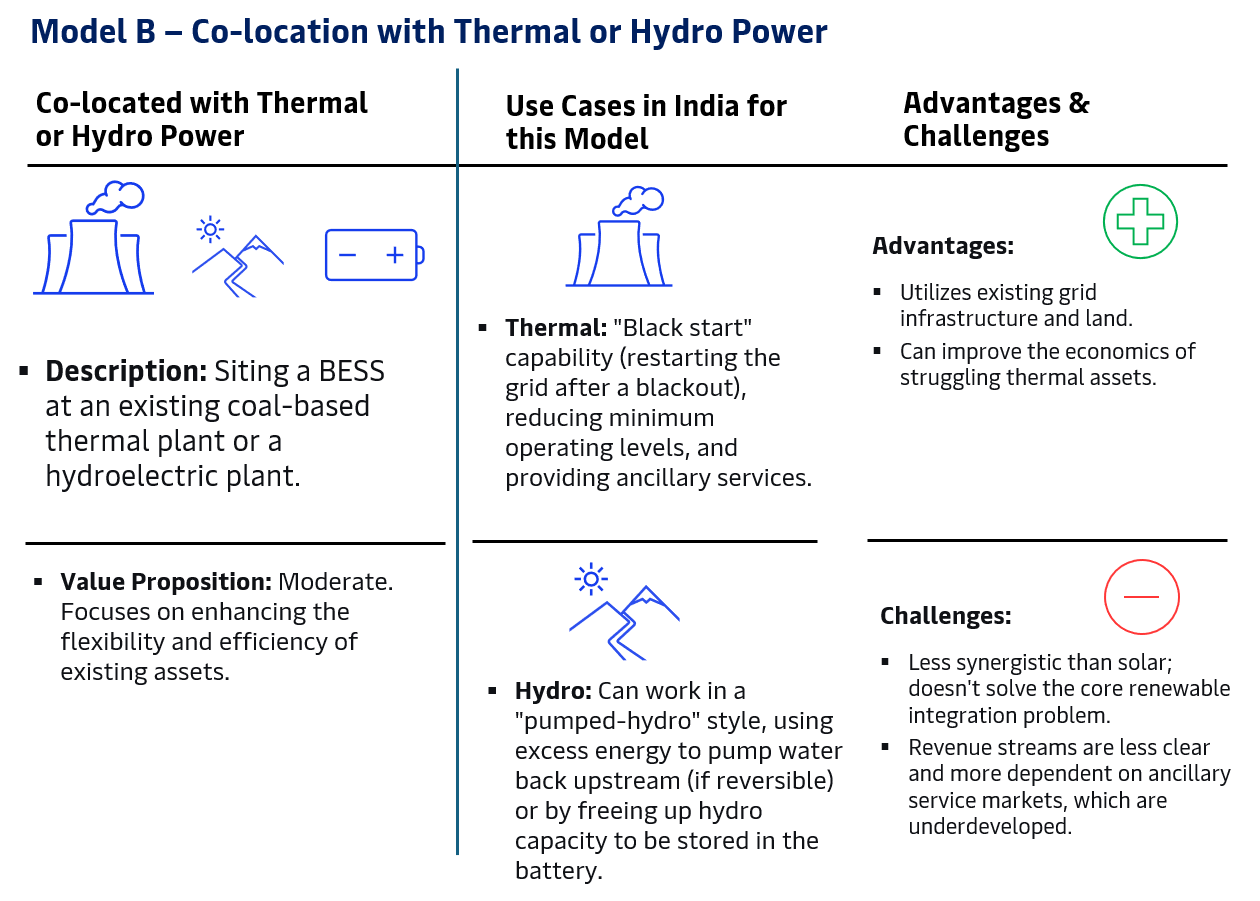

Analysis of Co-location Models in India

A hybrid solar plus storage plant offers the strongest economics. A dedicated BESS shifts solar output from

noon to the evening peak. A storage duration of four to six hours matches India’s peak window and current

VGF norms. This model supports energy shifting, peak supply, RTC delivery and curtailment capture. It lowers

project level costs by using one interconnection point.

It carries a high capital cost and needs

strong

scheduling discipline, yet it delivers the most reliable revenue stack in today’s market. A BESS co located

with a thermal or hydro plant offers moderate potential. Coal plants gain better flexibility and reduced

technical minimums. Hydro plants can reserve water for high value hours or operate in a pump like cycle if

they are reversible.

This model works well where land and interconnection already exist. Revenue

depends on

ancillary services and flexibility markets that are still developing. It does not address the main

intermittency challenge of solar, so value is constrained.

Key Recommendations for India – Facing the Risks

The question is no longer ”if” one should co-locate batteries in India, but ”how” to do it

most effectively.

The Indian power sector's structural shifts create a compelling business case. While several models exist,

the Hybrid Solar + Storage power plant, explicitly configured for energy shifting and peak power

management,

stands out as the model that adds the most value.

It directly turns India's biggest energy

challenge solar

intermittency, into a lucrative opportunity, ensuring grid stability and maximizing return on investment for

developers while supporting the nation's clean energy goals.

Recommendations for Co-locating BESS in India – Eninrac Insights

-

Prioritize Solar Co-location: For new developments or retrofits, the Hybrid Solar+Storage model is the most attractive

-

Target 4-6 Hour Duration: This duration is the current sweet spot for aligning with peak demand and policy incentives.

-

Secure a Long-Term PPA: Before investing, secure a PPA for peak power or RTC power to de-risk the revenue stream. Engage with DISCOMs and participate in government tenders

-

Leverage Government Support: Actively explore the Central Financial Assistance (CFA) available through the VGF scheme for BESS

-

Site-Specific Analysis: Conduct a deep-dive analysis on grid congestion, solar resource, and local peak demand patterns to optimize the location.

Risk Mitigation

-

Technology Risk: Use reputable battery vendors with strong warranties. Factor in degradation and performance guarantees.

-

Financial Risk: The high Capex is the biggest barrier. Utilize the VGF scheme and explore innovative financing models like blended finance or green bonds.

-

Regulatory Risk: Stay abreast of evolving regulations from the Central Electricity Authority (CEA) and Ministry of Power regarding storage integration and market participation.