The emergence of AI data centers is expected to create a market size of nearly US$ 3-7 Trillion globally by 2032

Global data center market presents a compelling, multi-year growth opportunity across the full value chain. Structural demand drivers—including accelerated AI adoption, continued cloud penetration, and enterprise-wide digital transformation—are underpinning robust capacity expansion. Learn about the opportunity hubs with Eninrac’s “Global Datacenter Market Trends & Outlook: A Strategic Perspective & Investment Potential for the Value Chain Players till 2030”

The Strategic Landscape : Why this Time is Different ?

1. The Scale Imperative -

- Historical Context: Traditional data centers operated at 5-20 MW scales

- Future Reality: AI demands 100MW to 1GW+ campuses—an order-of-magnitude leap

- Investment Implication: This scale transition creates winner-take-most dynamics where early movers securing power, land, and supply chain access will dominate regional markets

2. The Architectural Revolution –

- AI Model Innovation: Distilled and distributed training models are fundamentally reshaping infrastructure requirements

- Design Philosophy Shift: Moving from standardized "box" construction to purpose-built AI factories

- Competitive Advantage: First-movers in next-generation designs will achieve 30-40% efficiency premiums over legacy approaches

Exhibit 01 : Anticipated Capital Investments to Support AI-Related Datacenter Capacity Demand across Distinct Global Regions

Strategic Investment Opportunities by Value Chain Position

1.Power Infrastructure & Utilities: The New Kingmakers Navigate GCC’s Hyperscale Datacenter Opportunity with Eninrac’s Outlook to 2030

Strategic Plays:

- Grid Edge Dominance: Invest in behind-the-meter generation (SMRs, advanced geothermal) to bypass constrained utility grids

- Power-as-a-Service Models: Develop turnkey solutions bundling renewables, storage, and grid connectivity at campus scale

- Thermal Management Innovation: Position in liquid cooling and waste heat recovery systems becoming essential at 50kW+ rack densities

Valuation Multiplier: Companies that solve the power bottleneck will command premium multiples as critical-path enablers of the entire AI ecosystem

2. Engineering, Procurement & Construction (EPC): From Builders to Strategic Partners

Strategic Plays:

- Platform-Based Delivery: Develop standardized, repeatable campus designs that accelerate time-to-market from 3+ years to 18 months

- Technology-Enabled Construction: Integrate modular fabrication, digital twins, and AI-driven project management

- ces: Expand from construction to ongoing optimization services through data center operations

Value Capture: Leading EPCs can transition from low-margin contractors to high-margin technology integrators with recurring revenue streams

3. Real Estate & Land Development: The Scarcity Play

Strategic Plays:

- Portfolio Accumulation: Secure option positions on land parcels near substations and fiber trunks ahead of demand signals

- Master-Plan Communities: Develop integrated digital infrastructure parks with shared utilities and connectivity

- Brownfield Conversion: Repurpose industrial sites with existing power entitlements and transportation access

Appreciation Potential:Prime data center land in strategic corridors has appreciated 300-500% in 3 years—a trend accelerating with AI demand

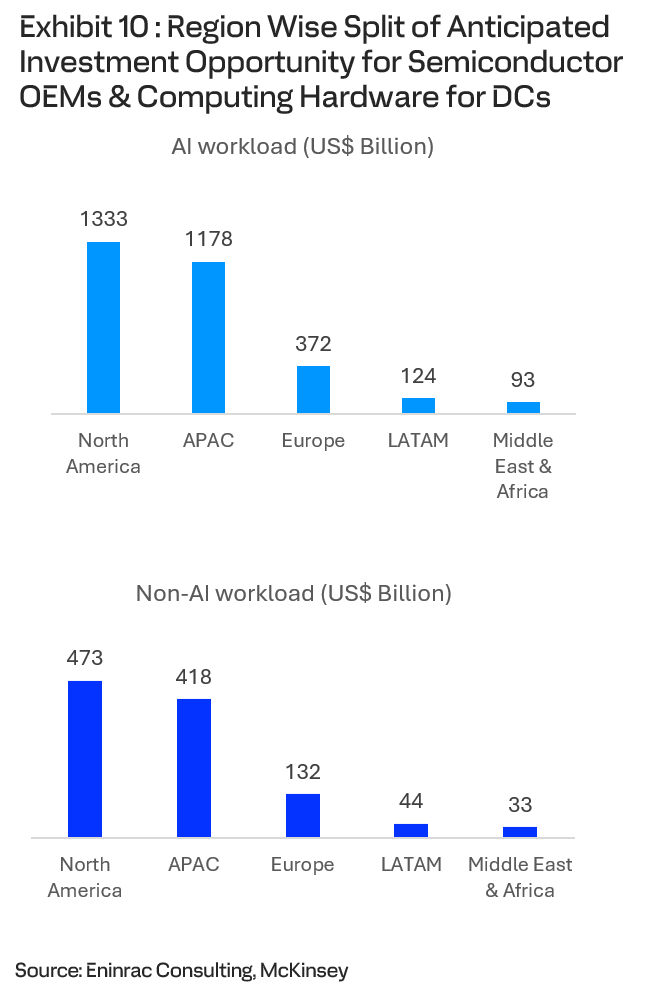

4. Semiconductor & IT Hardware : The Engine Room

Strategic Plays:

- Full-Stack Optimization: Design integrated systems (silicon + cooling + networking) optimized for specific AI workloads

- Energy-Performance Leadership: Capture premium pricing for solutions delivering higher computations per watt

- Subscription Models: Shift from capex sales to compute-as-a-service recurring revenue stream

Market Position: Leaders here control the innovation cadence of the entire AI industry through architectural decisions

5. Operators & Hyperscalers: The Scale Arbitrage

Strategic Plays:

- Vertical Integration: Control the stack from chip design to energy procurement to application delivery

- Geographic Portfolio Optimization: Balance workloads across regions based on energy costs, latency, and regulatory environments

- Platform Ecosystem: Leverage infrastructure scale to create developer ecosystems with network effects

Competitive Advantage : For instance, the ability to deploy $10B+ in single campus developments creates barriers that only sovereign wealth funds and mega-cap tech can overcome

The Convergence Play: Integrated Infrastructure Platforms

The Ultimate Strategic Position: Companies that can bundle land + power + construction + operations into single-point solutions will capture disproportionate value.

Emerging Model:"AI-Ready Campus" providers offering:

- Pre-permitted, powered land

- Build-to-suit scalable capacity

- Guaranteed PUE and connectivity SLAs

- Optional colocation or build-to-own models

Investment Opportunity: This integrated model commands 15-30% valuation premiums over single-segment players due to:

- Reduced customer friction

- Higher margin profile

- Defensible competitive position

- Recurring revenue characteristics

Key Market Highlights – Global Datacenter Market

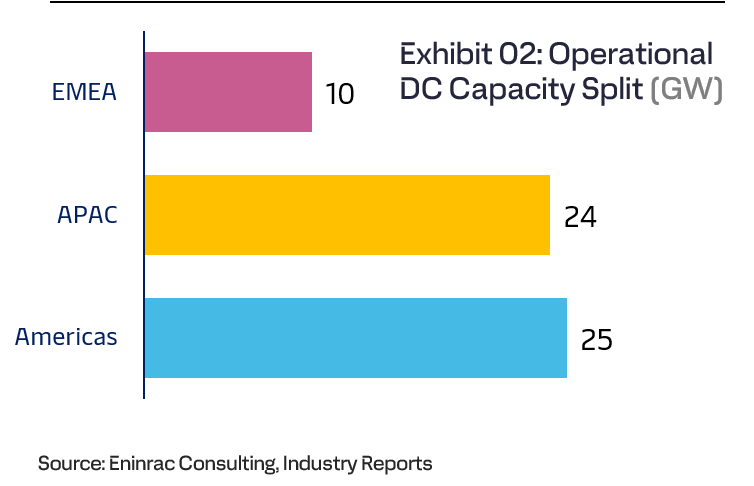

Global Operational Market Capacity for Datacenters – nearly 59 GW

The Americas lead the global data center market with an operational capacity of 25 GW. Virginia stands out as the world’s largest hub, hosting 6 GW—nearly 24% of regional and 10% of global capacity. Within the region, six mature markets have already surpassed the 1 GW threshold, underscoring the scale and concentration of infrastructure investments.

APAC is the second largest datacenter market with an operational capacity of 24 GW. Decode India’s Datacenter Growth Story with Eninrac’s Strategic Market Outlook to 2030

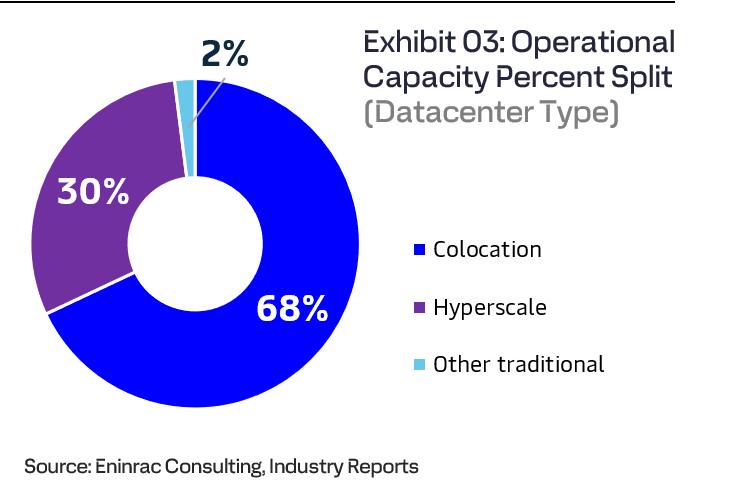

Hyperscalers account nearly 30% of the operational datacenter capacity

Hyperscalers account for nearly 17.7 GW of operational data center capacity worldwide, with the Americas contributing approximately 46% of this total. This concentration underscores the region’s strategic importance in the hyperscale ecosystem, reflecting its robust cloud adoption, favorable regulatory and energy environments, and continued dominance as the preferred destination for large-scale digital infrastructure investments

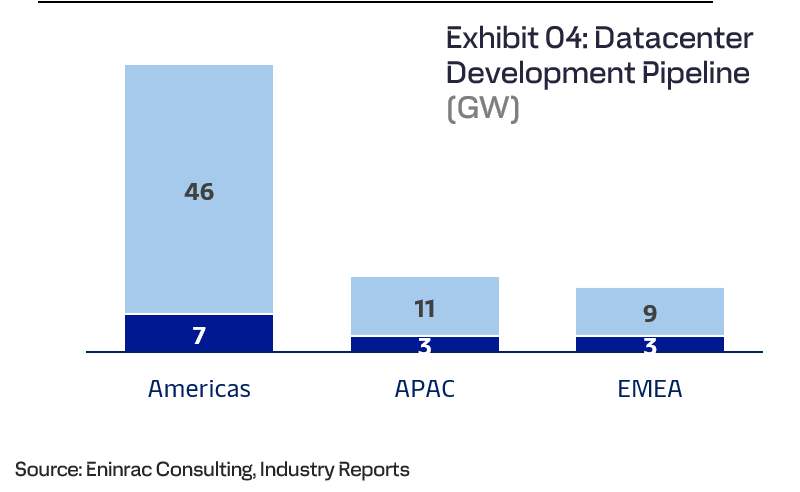

An additional ~79 GW of the capacity is under the development pipeline

Of the datacenter capacity under development- nearly 13 GW is under construction while 66 GW is under development

Within this pipeline, hyperscalers account for nearly 3 GW of the capacity under construction and an additional 7 GW of planned capacity.

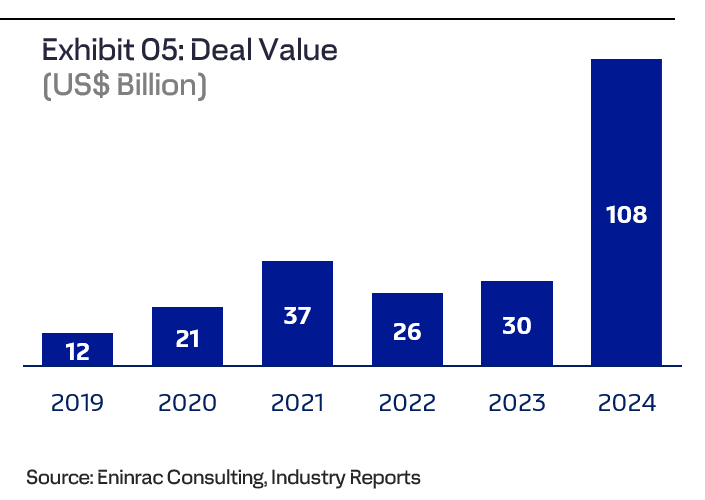

800% jump in the private equity investment in datacenters

The surge in demand for AI technologies, coupled with the accelerated build-out of digital infrastructure, has significantly heightened private equity interest in the data center sector. In 2024, private investments in the industry reached $108 billion

Blackstone emerged as the largest global data center investor with its landmark $16 billion acquisition of AirTrunk, while Vantage Data Centers secured the second-largest funding inflow, attracting $9.2 billion in the same year

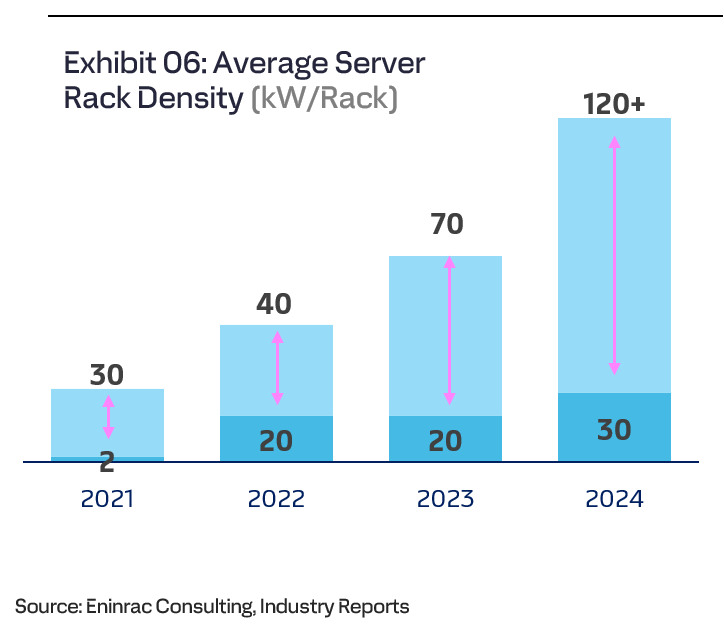

The average server rack density ranges between 30-120 kw/rack

AI servers generate such high heat loads that traditional air cooling becomes ineffective beyond ~50 kW per rack—sufficient for inference workloads, but inadequate for more power-intensive training workloads.

Rising rack densities have driven a shift from air to liquid cooling, which more effectively removes heat. Key technologies include rear-door heat exchangers (40–60 kW), direct-to-chip cooling (60–120 kW), and liquid immersion (100–150+ kW). Adoption remains gradual, limited by cost, infrastructure changes, and environmental concerns around certain fluids.

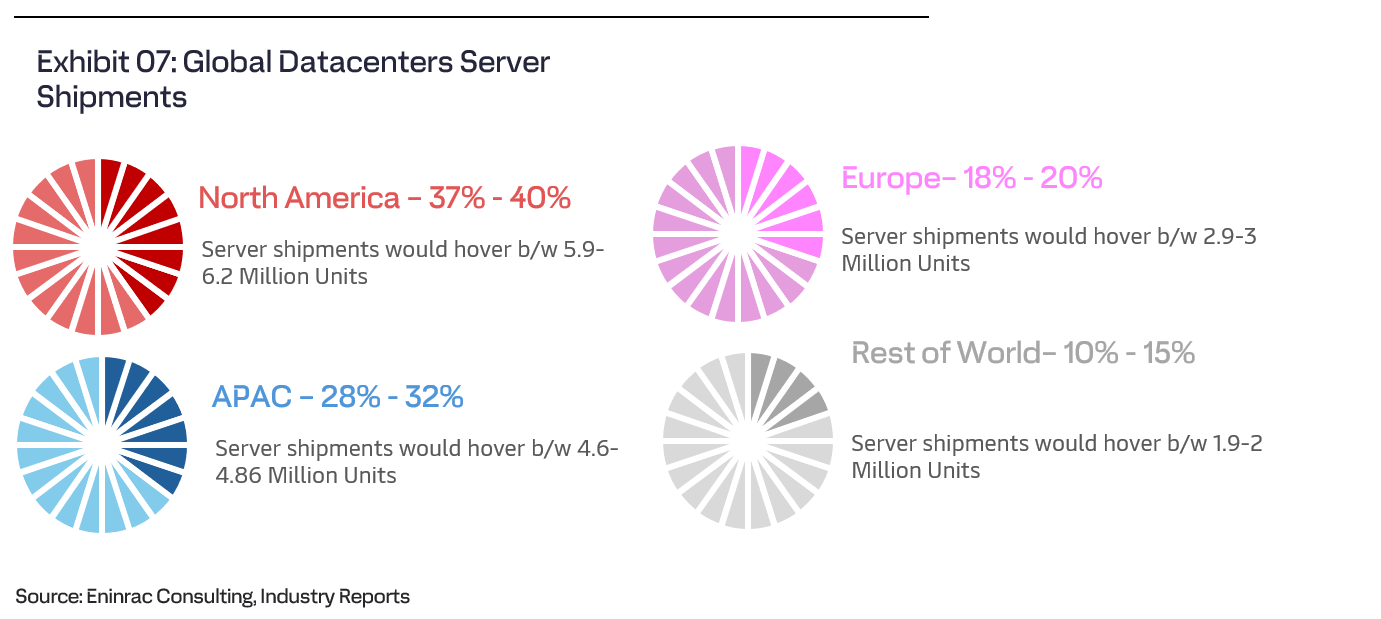

The global datacenter server shipments are anticipated to grow between 5-8% annually till 2029 with continued shift toward GPU-accelerated and AI-ready server types

The average global datacenter server shipments are anticipated to hover between

15.5-16.2 Million million in 2025. Of this, the regional breakdown would be as

follows:

North America – 37-40%

APAC- 28-32%

Europe-18-20%

RoW- 10-15%

The spend on servers was estimated to be around $250 Billion in 2024 Unlock the Opportunity with Eninrac’s Report: Europe Datacenter Market Outlook – A Strategic Perspective to 2030

Key Signpost – Strategic Opportunity for the Value Chain

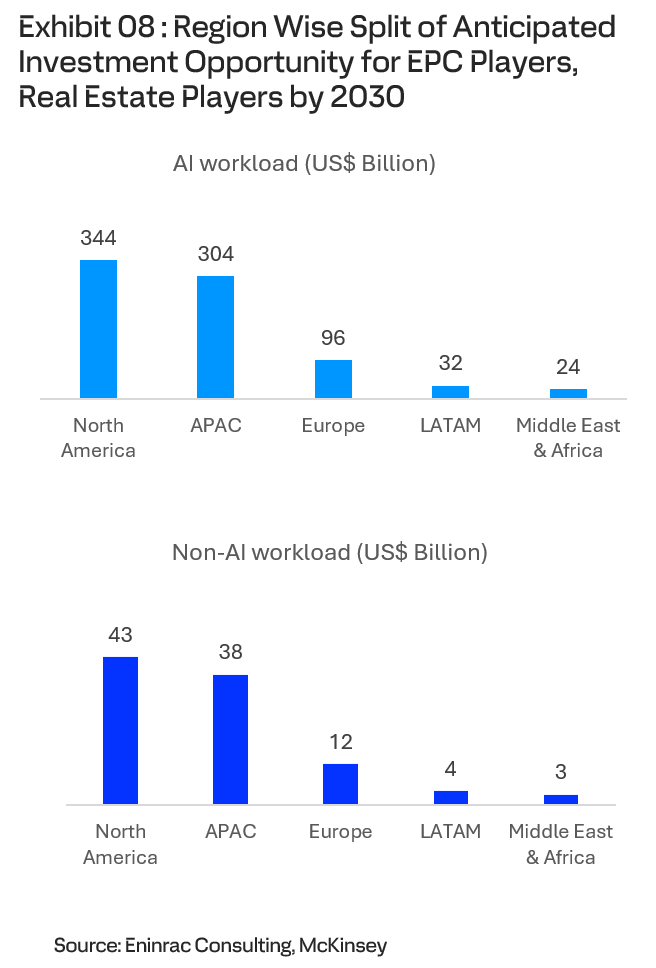

For EPC, Real Estate Players

Core Opportunity- Transition from commodity contractors to strategic partners by mastering accelerated, high-density deployment. The firms that deliver power-ready, modularized capacity at scale will capture disproportionate value in a land-constrained, time-sensitive market

Strategic Opportunity –

- Location as a Weapon: Secure and entitle sites with latent power and fiber access ahead of demand curves.

- Design-to-Operate Integration: Embed operational intelligence (cooling, rack density, serviceability) into blueprints, creating defensible IP and sticky client relationships.

- Industrialized Construction: Lead the shift to off-site fabrication—transforming construction from a bottleneck into a scalable, predictable delivery system

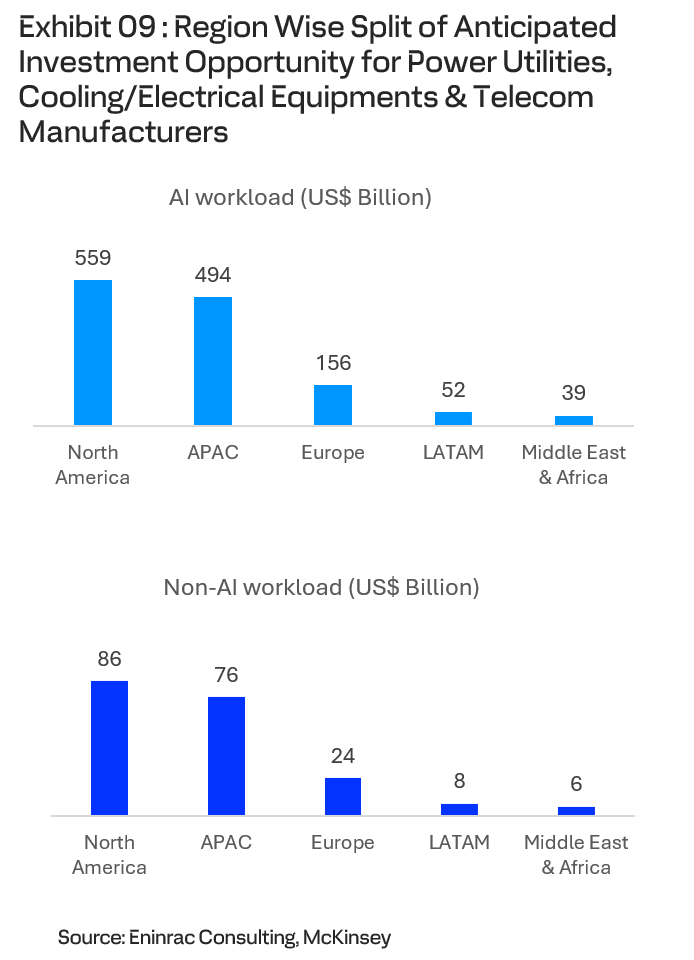

For Power Utilities, Electrical/Cooling Equipments & Telecom Manufacturers

Core Opportunity: Core Opportunity: Move beyond commodity power provision to become architects of sustainable, high-density energy ecosystems. The ability to deliver gigawatt-scale, 24/7 clean power with advanced thermal management will define market leadership.

Strategic Opportunity –

- Grid-as-a-Platform: Deploy capital not just for generation, but for transmission intelligence and storage buffers that turn grid limitations into monetizable reliability services.

- Thermal Innovation Premium: Own the cooling stack—from direct-to-chip to immersion solutions—as power densities make thermal management the critical path to compute availability.

- Clean Energy Arbitrage: Bundle nuclear, geothermal, and next-gen renewables with AI load profiles to command premium pricing and secure anchor-tenancy agreements.

For Technology Developers & Designers (Semiconductors, IT Hardware)

Core Opportunity: Leverage architectural control to set the pace and direction of AI advancement. This is not merely a chip sale—it is defining the computational substrate upon which all AI innovation is built.

Strategic Opportunity –

- Full-Stack Influence: Use hardware dominance to shape software ecosystems, creating formidable moats through developer tools, libraries, and platform optimizations.

- Strategic Capacity Allocation: In a perpetually undersupplied market, allocation decisions become geopolitical and strategic tools—favoring partners who offer ecosystem alignment.

- Heterogeneous Architecture Leadership: Win the integration game by optimizing not just silicon, but the entire compute-memory-interconnect fabric for emerging AI workloads.

For Operators (Hyperscalers, col-12ocation, GPU-as-a-Service)

Core Opportunity: Evolve from infrastructure landlords to AI capability brokers. The winners will master the economics of heterogeneous workloads, maximizing utilization across training, inference, and legacy compute.

Strategic Opportunity –

- Software-Defined Efficiency: Deploy AI to manage AI infrastructure—creating self-optimizing data centers where predictive automation drives capital and operational efficiency.

- Demand Shaping: Use pricing, API access, and service tiers to smooth demand curves and maximize asset yield across unpredictable workload patterns.

- Vertical Integration Depth: For hyperscalers, the true advantage lies in tightly coupling infrastructure with model development, creating flywheels where each informs and accelerates the other

For AI Architects (Model Developers, Enterprises)

Core Opportunity: Transform from algorithm developers into architects of economic value. The goal is not just model performance, but computational efficiency that translates to enterprise profitability.

Strategic Opportunity –

- Algorithmic Capital Efficiency: Pioneer architectures where performance gains outpace compute cost increases—this is the new competitive battlefield.

- Proprietary Workload Advantage: Enterprises that build domain-specific AI will create defensible data-to-insight pipelines that cannot be replicated by generalist cloud offerings.

- Inference Economics Mastery: Control the 90%+ of AI lifetime cost by designing models optimized for efficient, scalable inference deployment