Will India’s critical minerals sector leverage policy reforms, domestic exploration, and global partnerships to achieve strategic autonomy, or will import dependence and technological gaps limit its growth and global competitiveness?

Why is a comprehensive assessment of India’s critical minerals market dynamics essential for unlocking a ₹1.2 lakh crore (US$15 billion) growth opportunity by 2030, addressing import dependency, investment trends, domestic and export value chains, and shaping strategic global competitiveness against China?

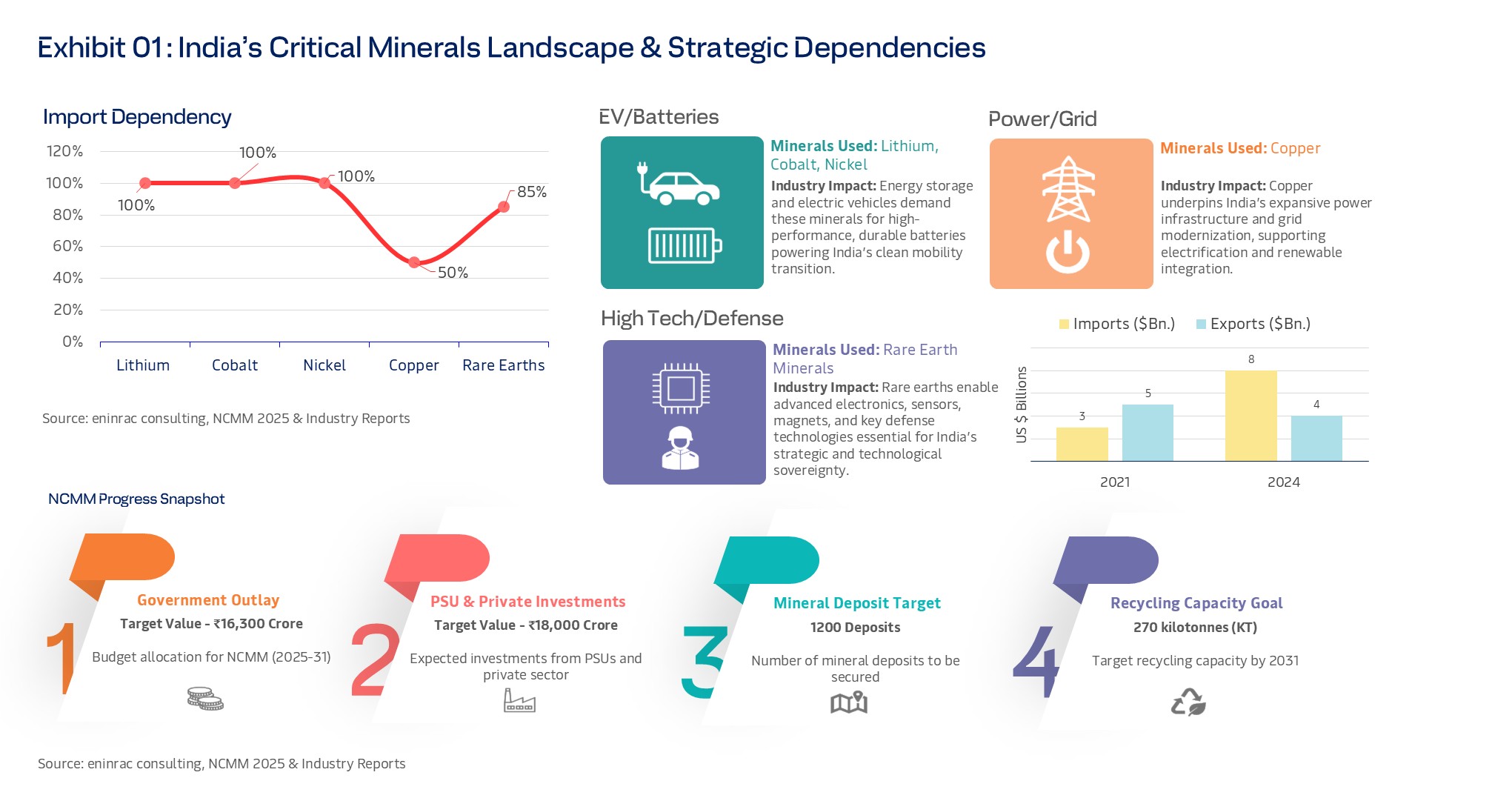

India has identified five critical minerals like Lithium, Cobalt, Nickel, Copper, and Rare Earth Elements and remains pivotal for driving its clean energy transition and achieving technological independence. The launch of the National Critical Minerals Mission (NCMM) in 2025 marks a transformative initiative to secure domestic supply chains, boost exploration, and cut reliance on imports. With a combined government and private investment outlay exceeding ₹34,000 crore for 2025-31, the mission aims to identify 1,200 deposits, scale recycling capacities, and foster innovation through Centres of Excellence.

Despite these efforts, India continues to face high import dependence, ranging between 70% and 100%, particularly for minerals like lithium, cobalt, and nickel that are essential for battery manufacturing and EV production. This dependency underscores the strategic urgency to enhance domestic production capabilities and diversify sources internationally to reduce geopolitical risks and supply disruptions. The critical minerals prioritized underpin key sectors such as electric vehicles, renewable energy, advanced electronics, and defense. Lithium, cobalt, and nickel predominantly serve batteries and alloys, while copper is vital for power infrastructure and grid modernization. Rare earth elements, crucial for high-tech and defense applications, have a significant import footprint on India’s supply chain, necessitating focused domestic capabilities. India’s critical minerals sector faces significant import dependency risks, especially for lithium, cobalt, nickel, and rare earth elements, all crucial for the country’s clean energy ambitions. This heavy reliance underscores the urgency for domestic resource development and diversification of import sources.

What are the key demand drivers fueling growth in India’s critical minerals market, and how are they reshaping the outlook for 2025–2030 and beyond?

India’s critical minerals market is set for robust growth, driven by structural and policy-driven demand dynamics. Structurally, the surge in electric vehicle adoption, renewable energy expansion, and advanced manufacturing are driving unprecedented demand for lithium, cobalt, nickel, copper, and rare earth elements. Policy initiatives such as the National Critical Minerals Mission (NCMM) are enhancing domestic exploration and capacity building with a projected investment of ₹34,300 crore through 2031. Additionally, efforts to develop a 270-kilotonne recycling capacity and foster innovation through multiple Centres of Excellence are expected to further strengthen the supply chain and reduce import dependency, positioning India for a multi-billion-dollar market opportunity by 2030.

Market Size, Demand Growth & Export Trends

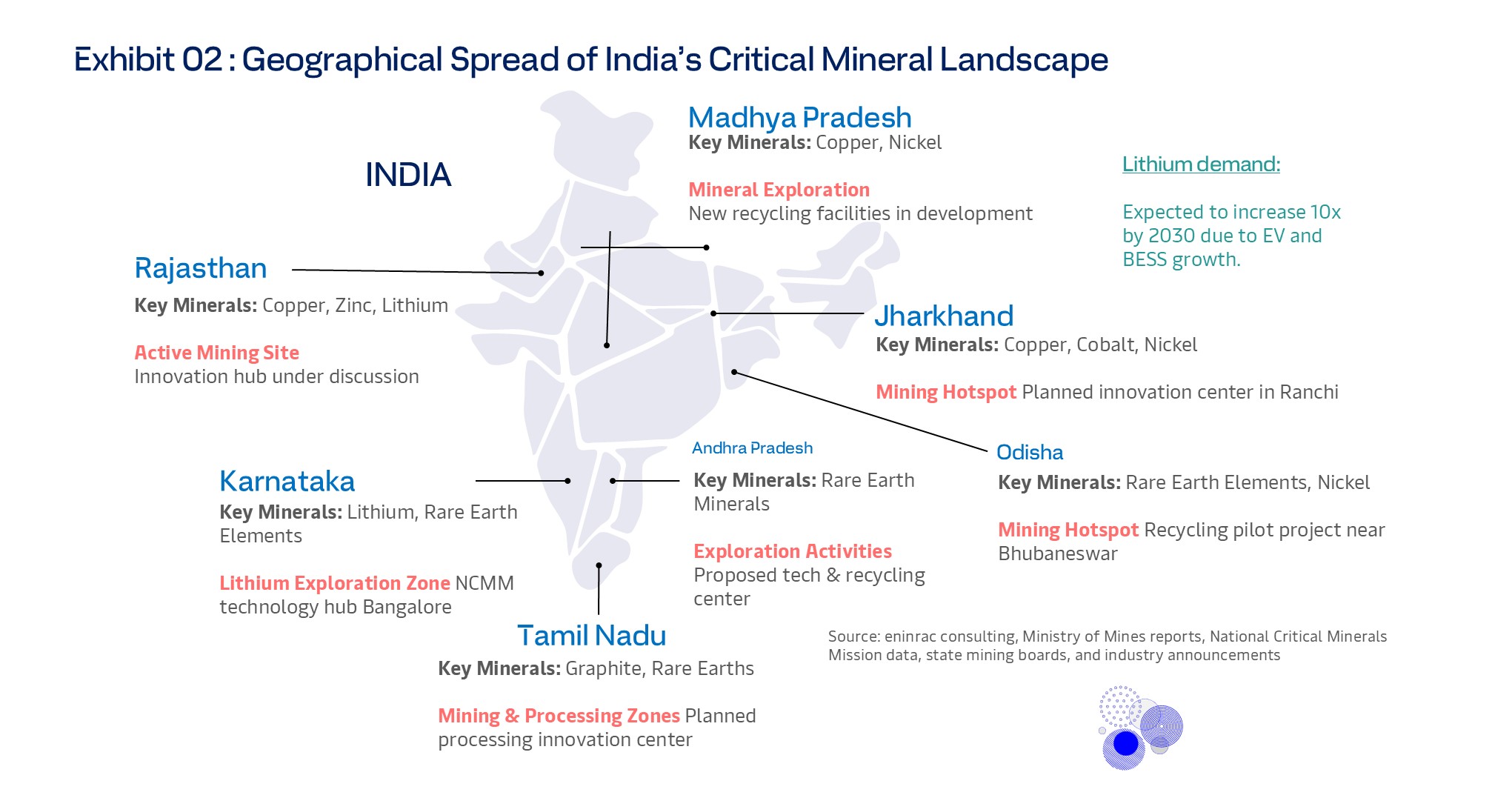

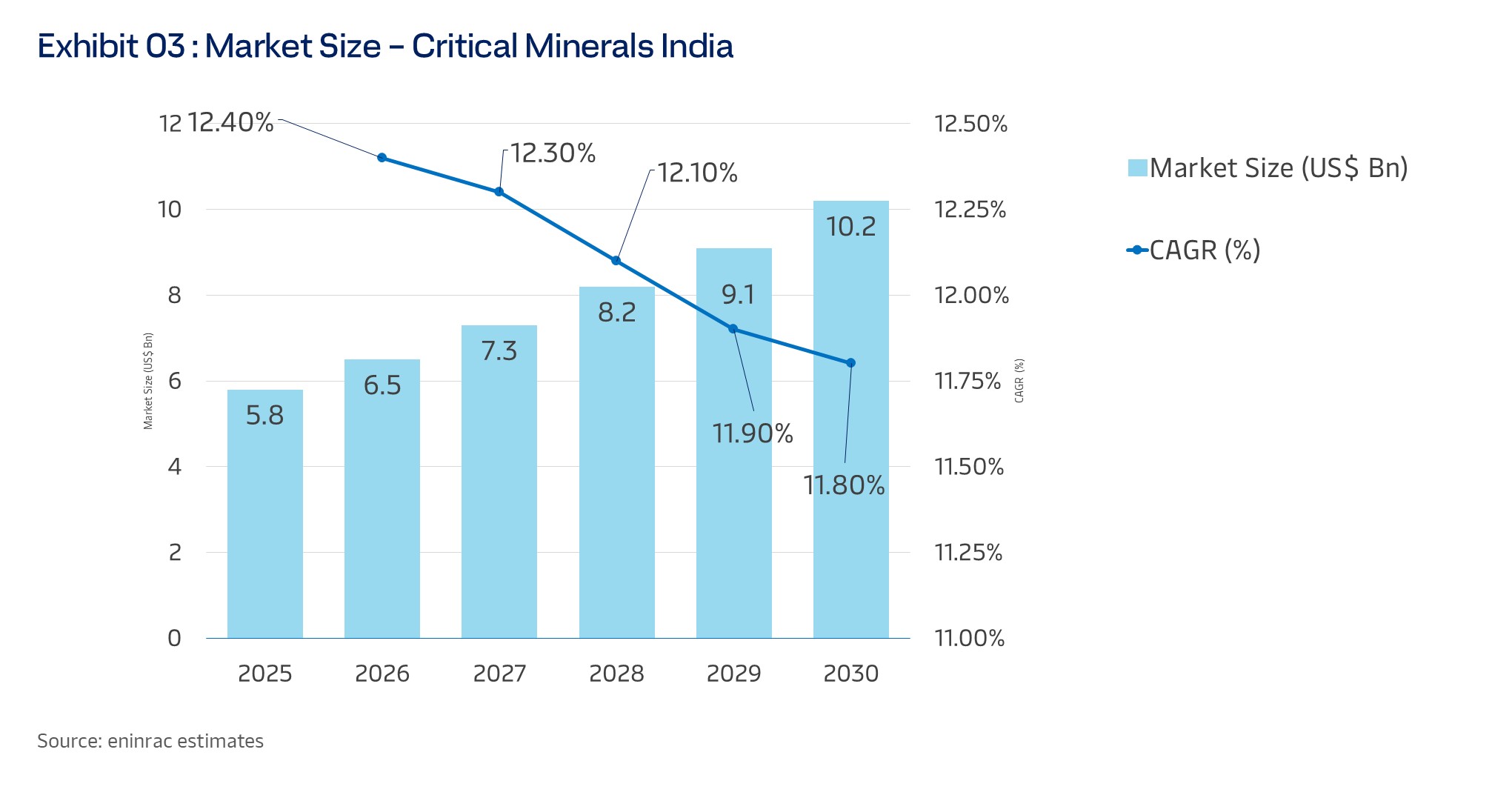

India’s critical minerals market is projected to grow at a CAGR of 12%+, crossing $10B in value by 2030, driven by advanced manufacturing and renewable energy infrastructure. India’s critical minerals market is witnessing exponential growth, propelled by the rapid expansion of clean energy infrastructure and advanced manufacturing sectors. The nation’s ambitious renewable energy target of 500 GW by 2030 and the push for electric vehicle (EV) adoption are driving demand for essential minerals like lithium, cobalt, nickel, copper, and rare earth elements. Specifically, lithium demand is projected to increase tenfold by 2030, while copper demand is expected to more than double, underscoring the centrality of these minerals in India’s energy transition and industrial modernization

India's critical minerals market is projected to exceed $10 billion by 2030, growing at a compound annual growth rate (CAGR) of over 12%. This robust expansion is driven primarily by the nation's ambitious renewable energy target of 500 GW by 2030, rapid adoption of electric vehicles (EVs), and significant growth in advanced manufacturing sectors.

Market Size, Demand Growth & Export Trends

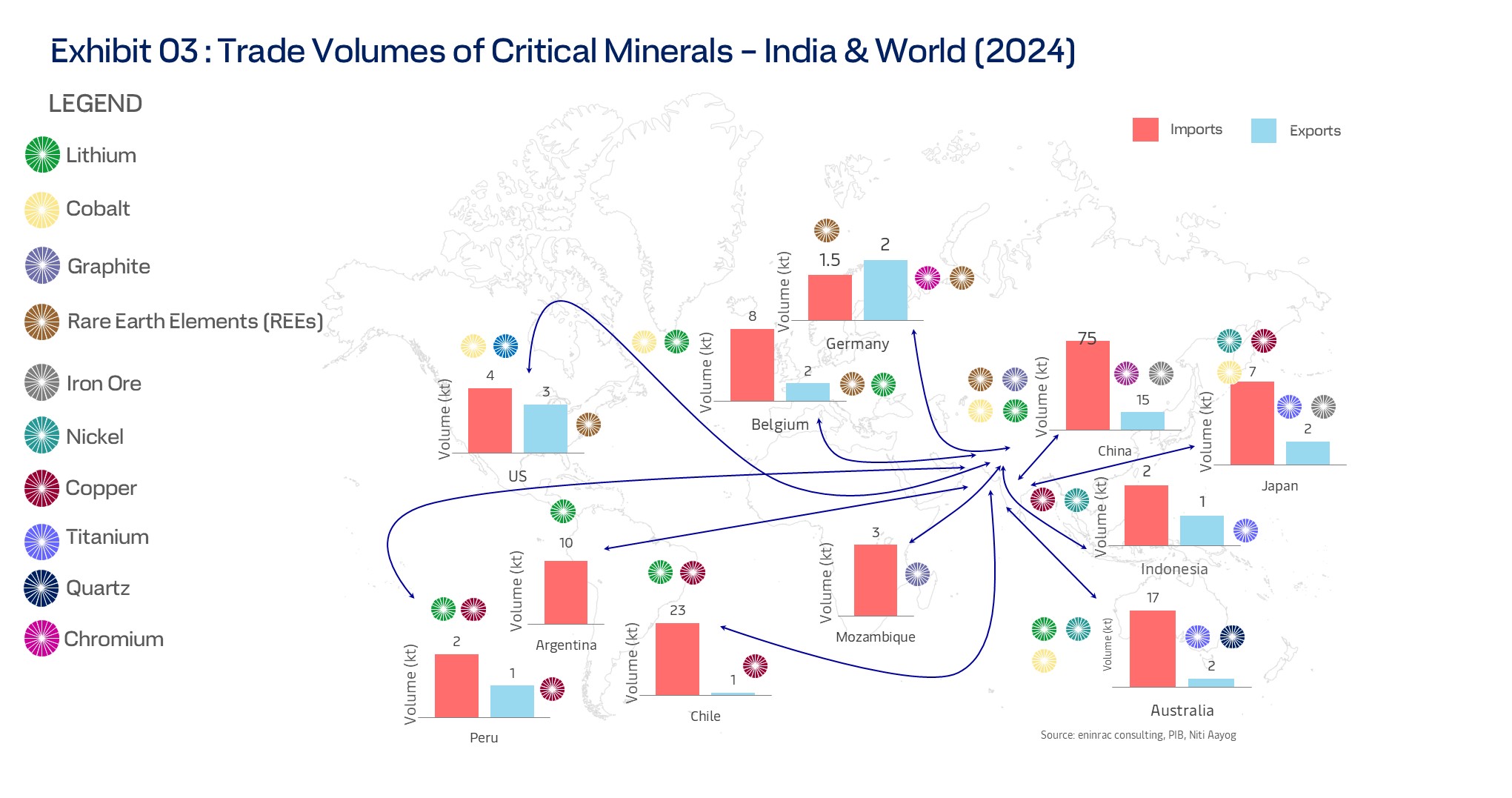

India’s critical minerals trade landscape is shaped by its heavy reliance on imports, targeted international partnerships, and emerging export ambitions, especially in the context of green energy transition, advanced manufacturing, and national security. The nation’s trade partners vary depending on the mineral, with country-wise relationships evolving rapidly due to global supply chain volatility, technological needs, and policy initiatives. India is almost 100% import-dependent for lithium, cobalt, and several other minerals. China is the single largest supplier for most critical minerals which notably are lithium, REEs, graphite, and cobalt holding substantial sway over India’s supply chains. Emerging partnerships with Australia (lithium, cobalt), Peru, Chile, and Argentina (lithium, copper) reflect India's strategic efforts to diversify supply and reduce reliance on China.

Strategic Overview & Policy Landscape

- National Critical Mineral Mission (NCMM): Launched in 2025, this mission aims to secure domestic and overseas supply chains, invest in joint ventures, and boost recycling.

- KABIL Consortium (Khanij Bidesh India Limited): A government-backed entity tasked with acquiring overseas mineral assets (Australia, Argentina, Africa) for sustained supply.

- FTAs and Bilateral Partnerships: India is negotiating FTAs with Chile and Peru to secure lithium and copper. Active partnerships with Australia and Argentina are focused on direct investment and joint exploration.

- Import Diversification: Recent policy and trade moves aim to lessen dependency on China, with a focus on Latin America, Africa, and Australia for strategic minerals and achieving supply chain resilience

Rare Earth Elements (REE) Processing

India benefits from established rare earth processing capabilities concentrated in public sector undertakings, aiming to scale up production of high-purity rare earth compounds.

- India Rare Earths Limited (IREL): IREL operates multiple units focused on rare earth extraction and refining techniques. The Rare Earths Division (RED) in Aluva, Kerala, processes monazite to extract lanthanum, cerium, neodymium, praseodymium, samarium, gadolinium, and yttrium compounds with purities >99%. The Odisha Sand Complex (OSCOM) is a major beneficiation and extraction site that processes beach sand minerals rich in REEs and associated heavy minerals.

- Rare Earth Extraction Plant (REEP): Located in Odisha, producing mixed rare earth chloride (MRCL) with a capacity of 11,200 tonnes per annum, feeding downstream pure rare earth oxides and compounds plants.

Cobalt and Nickel Refining

India currently imports most cobalt and nickel raw materials but has developed refining capacities to support domestic battery manufacturing.

- Cobalt Refining Capacity: Estimated at around 2,060 tonnes annually, with major refiners like Nicomet Industries Ltd. (Goa) and Rubamin Ltd. (Vadodara). Nicomet produces cobalt cathodes that meet London Metal Exchange (LME) specifications, serving growing battery and aerospace sectors.

- Nickel Production and Recovery: Hindustan Copper Limited (HCL) runs the Indian Copper Complex in Jharkhand, which includes the "Nickel, Copper and Acid Recovery Plant" producing LME-grade nickel metal from primary and secondary sources. Odisha holds considerable nickel resources (~175 million tons), fueling expected domestic market growth.

Emerging Developments & Policy Initiatives

India currently imports most cobalt and nickel raw materials but has developed refining capacities to support domestic battery manufacturing.

- National Critical Mineral Mission (NCMM) aims at securing supply chains, boosting exploration, supporting processing infrastructure, and establishing mineral parks with modern facilities nationwide.

- Recycling and Urban Mining: Besides raw material supply, NCMM incentivizes recycling critical minerals from e-waste and spent batteries with ambitious targets to recover 40 kilotonnes annually, reduce import dependency, and create up to 70,000 jobs.

- Technology & Collaboration: India is promoting public-private partnerships to develop extraction technologies, refining capacities, and downstream manufacturing to reduce reliance on imports and China’s processing dominance.