Nearly US$ 75 billion of investment is anticipated in GCC’s datacenter market by 2027

How are GCC nations accelerating a new era of digital expansion—where hyperscale datacentres emerge as the backbone of economic diversification, AI adoption, and cloud-driven growth? Discover the strategic edge shaping this transformation with Eninrac’s “GCC Datacentre Market Outlook: A Strategic Perspective to 2030

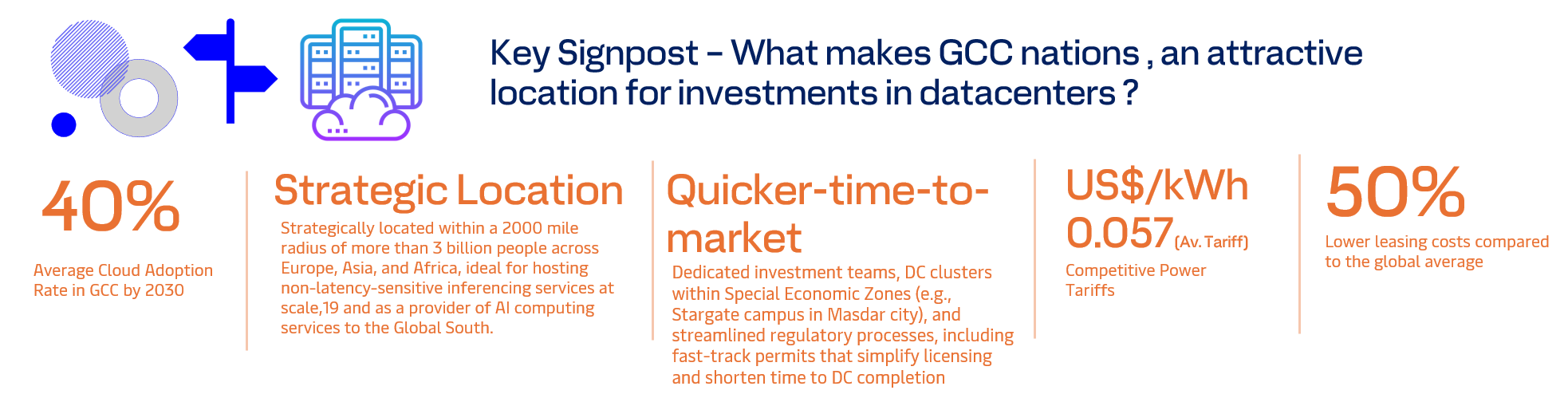

The GCC datacentre market in 2025 is positioned for unprecedented expansion, with Saudi Arabia and the UAE leading a fast-evolving landscape driven by sovereign projects, AI infrastructure ambitions, and accelerated enterprise cloud adoption. Capacity build-outs, regulatory modernization, and government incentives have transformed the region into a magnet for global and regional investment across hyperscale, colocation, and AI-ready datacentre assets.

Saudi Arabia and UAE anchor the GCC datacentre expansion, with Center3 targeting 1 GW total capacity by 2030, mostly in Saudi Arabia and Bahrain. UAE is set to increase its operational datacentre capacity by 165% by 2028, with investment pipelines exceeding USD 46 billion and an active buildout of 17 new facilities. Bahrain and select other MENA markets are experiencing parallel growth, spurred by digital transformation initiatives and public-private partnerships. To learn more about Eninrac market reports, visit eninrac store

The UAE has set ambitious goals to become a global leader in Artificial Intelligence (AI). AI is expected to contribute over USD 96 billion to the country’s GDP by 2031, with annual growth projected between 20-30%.

Saudi Arabia’s datacentre expansion capacity stands at 1963 MW, concentrated across key hubs. Neom leads with 1000 MW, reflecting its commitment to become the primary digital and commercial center. Dammam and Riyadh follow with 241.25 MW and 191.75 MW respectively, supported by strong colocation and hyperscale upcoming projects. Other regions collectively add 495 MW, showing growing nationwide infrastructure expansion beyond major metros

The Addressable Market

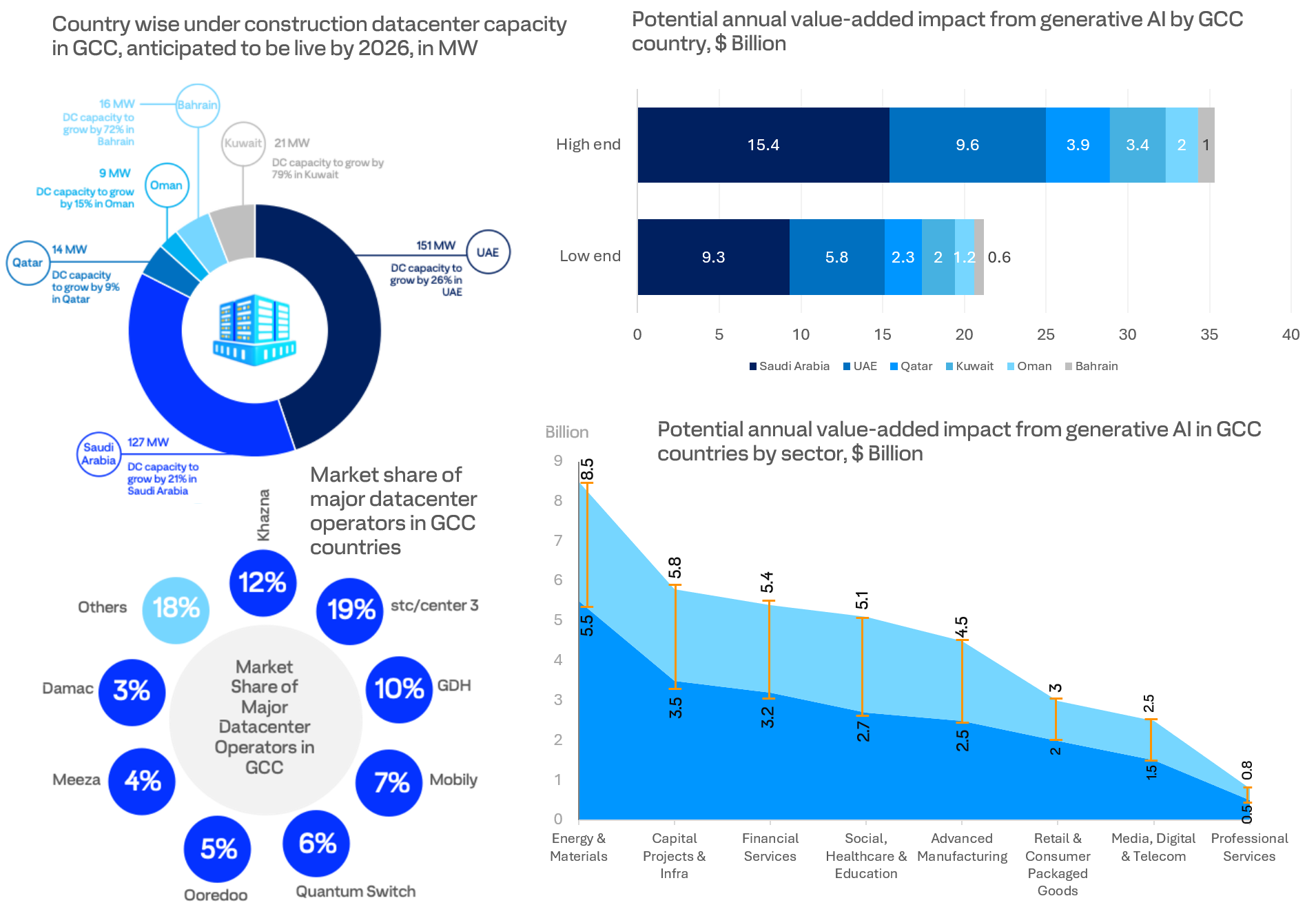

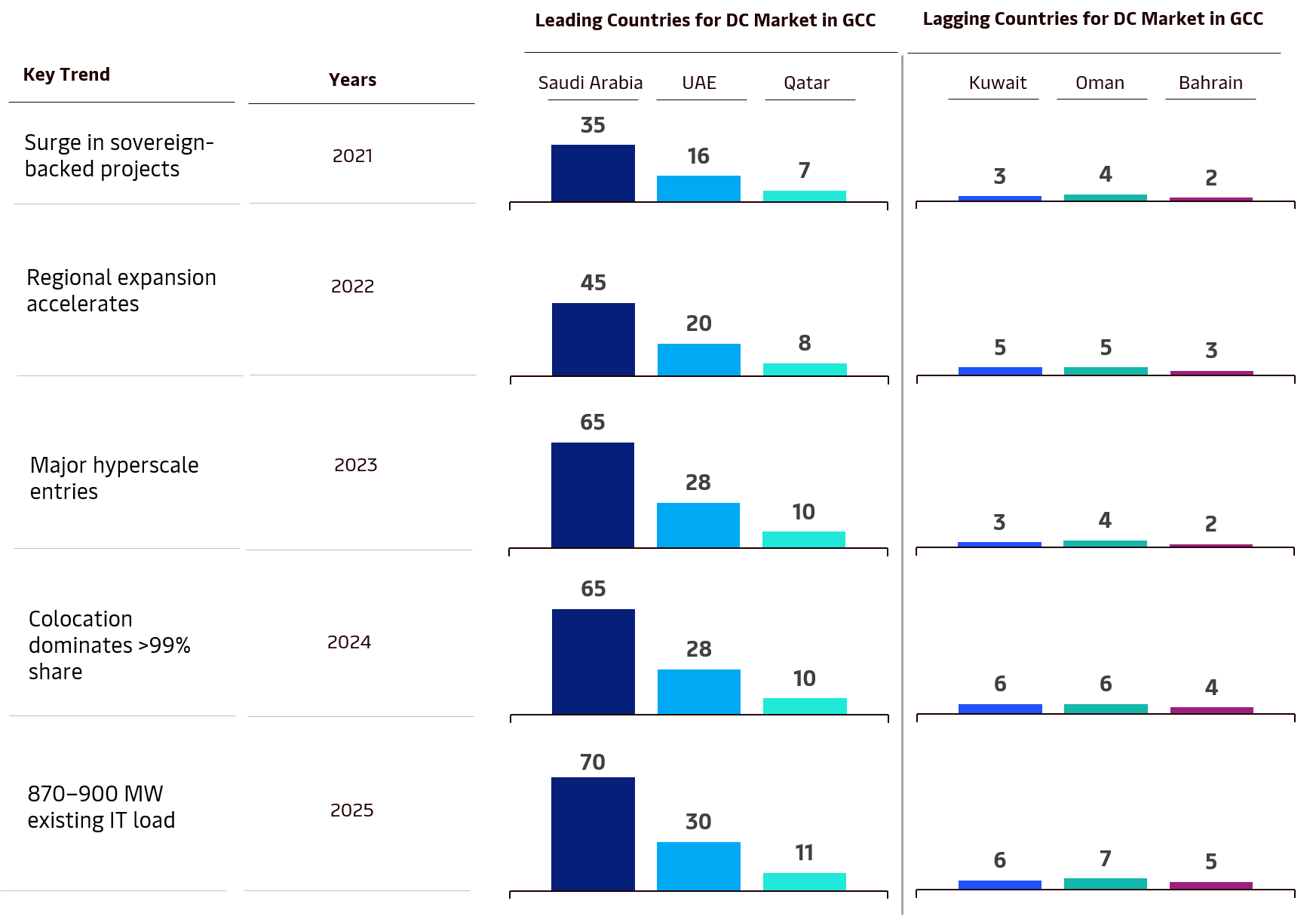

The GCC data center ecosystem has entered a phase of accelerated maturity. As of 2025, the region hosts an estimated 129 operational facilities with an aggregate IT load between 870–900 MW. Saudi Arabia and the UAE account for over two-thirds of this capacity, driven by hyperscale and sovereign digital infrastructure investments. An additional 4,000 MW of capacity is under development between 2024 and 2028, positioning the GCC as one of the fastest-growing data center hubs globally. Annual CapEx investment is projected at USD 3.1 billion, focused on civil works, power systems, and MEP infrastructure. Khazna Data Centers (UAE) remains the dominant player, holding approximately 70 percent market share across operating and under-construction capacity. The market remains predominantly colocation-led, though hyperscale and edge facilities are set to expand their footprint over the next decade.

IT Load Growth Trend (2018–2030): Scaling for Digital Sovereignty

The GCC and wider Middle East data center capacity has grown nearly 3.5 times between 2018 and 2025, propelled by rising hyperscale demand, cloud localization mandates, and enterprise digitization. IT load across the Middle East increased from ~330 MW in 2018 to ~900 MW in 2025, with projections crossing 1,300 MW by 2030. This capacity expansion reflects a clear regional intent to build sovereign digital ecosystems capable of supporting artificial intelligence, IoT networks, and data-intensive applications. The largest share of this incremental load is being absorbed by hyperscale data centers and government-backed digital infrastructure programs.

Facility Type Evolution: Transitioning Beyond Colocation Dominance

While colocation remains the backbone of GCC data infrastructure with over 99 percent share in 2024, market dynamics are gradually shifting. The rise of hyperscale facilities (5–7 percent projected by 2030) signals the maturing of cloud-native demand and digital transformation initiatives. Simultaneously, edge computing smart city programs, 5G rollouts, and AI-enabled low-latency applications across logistics, energy, and fintech sectors. This evolution marks a structural decentralization of data infrastructure, where hyperscale and edge nodes complement the colocation base, enabling both national data sovereignty and operational resilience.

GCC’s Data Center Landscape (Maturity Rate & Trend)

Datacentres are recognized as critical national infrastructure across GCC nations and receive strong policy-level support. In a notable recent development, Saudi Arabia unveiled Project Transcendence, a US $100 billion AI initiative aimed at positioning the Kingdom as a global leader in advanced digital capabilities. The sector is also benefiting from substantial investment in enabling infrastructure, especially connectivity. An expanding subsea cable network continues to strengthen the region’s strategic advantage as a digital bridge linking Asia, Europe, and the United States. Across the GCC, governments are competing to accelerate digital transformation and establish themselves as regional and global hubs for AI. Key drivers to the growth of datacentre market across the GCC countries -

Digital Transformation

As the population and businesses across the GCC embrace new technology, demand for data storage and processing power from datacentres grows exponentially. The GCC has a particular propensity to adopt to new technology given its younger demographic profile with around 50% of the population under 30

Cloud Adoption

Cloud computing services especially public and hybrid cloud are increasingly being adopted by both private enterprise and public sector organizations. As enterprise moves away from on-premise IT infrastructure, the demand for cloud enabled datacentres grows. The current and announced cloud regions in the GCC by major cloud providers such as AWS, Microsoft and Google. This year, AWS announced it will invest $5.3B in Saudi Arabia alone to support the growth of cloud adoption.

Government Initiatives

In efforts to diversify economic growth and move away from oil dependency, governments across the GCC are actively promoting the development of their tech sectors. Policy initiatives and national strategies like the 2030 Vision Plans and Smart City developments are aimed at attracting investment, fostering innovation and promoting digital transformation

5G Rollout and Emerging Technologies

The deployment of 5G networks and the rise of emerging technologies such as the Internet of Things (IoT), Augmented Reality (AR)/ Virtual Reality (VR), autonomous vehicles etc, is creating new data processing requirements to support low latency applications, leading to increased demand for edge computing solutions.

Artificial Intelligence (AI)

This is a demand driver that warrants a separate category of its own, such is the transforming effect it is having on the growth and shape of the sector. AI demands higher data processing and storage requirements with significantly greater power needs. New facilities are now being designed with much higher rack densities than before posing an obsolescence risk to older datacentres that need to upgrade their electrical and thermal capabilities.

Data Sovereignty Requirements

As countries implement stricter data residency and sovereignty laws, there is increasing demand for local datacentres to confine data within a country’s borders.