CURRENT LANDSCAPE OF EV MANUFACTURING - MOROCCO

Morocco’s role in making Africa epicenter of global electric mobility production & trade

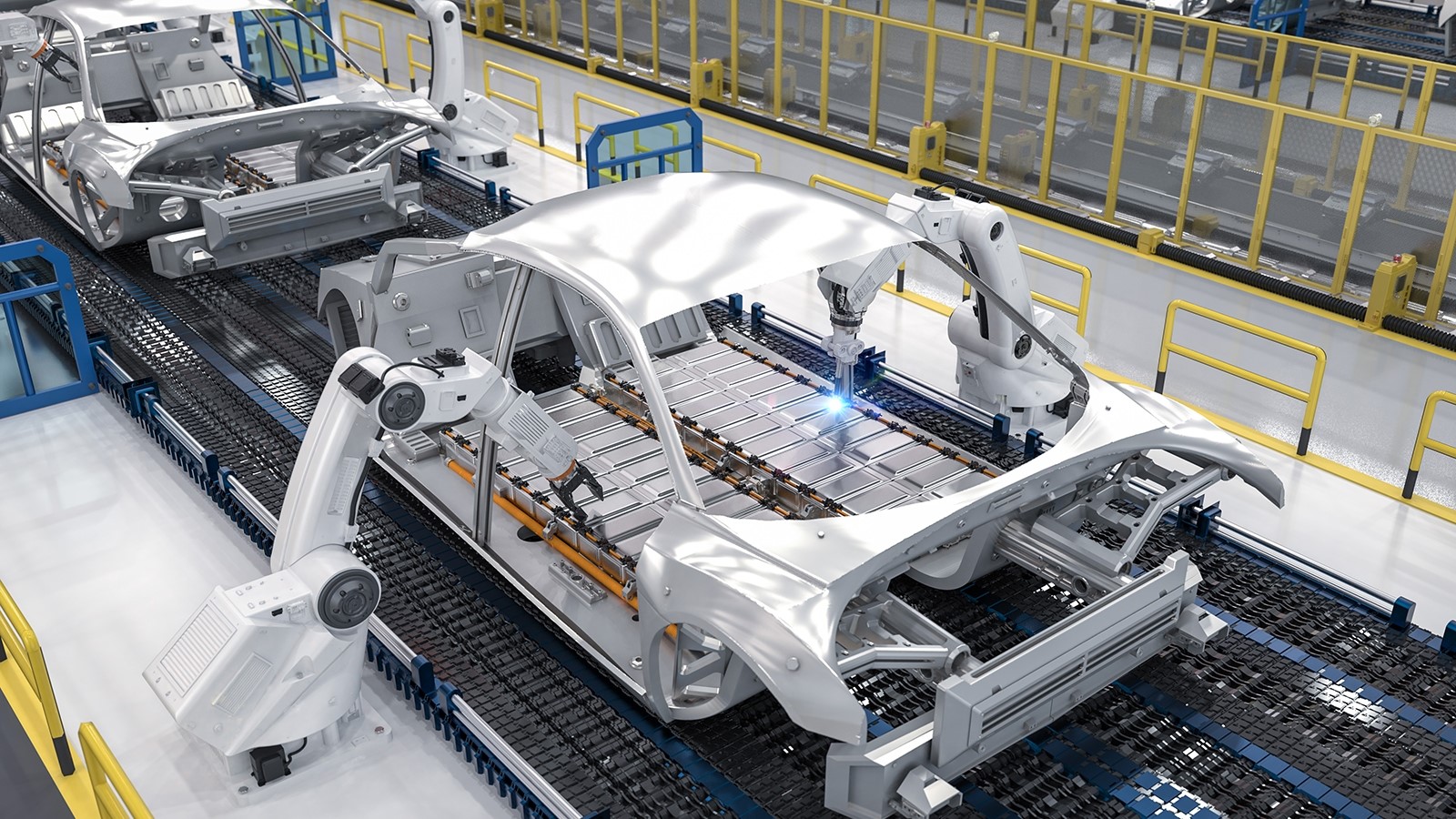

MOROCCO POSITIONING ITSELF AS A SIGNIFICANT HUB FOR EV TRANSITION

Morocco is increasingly positioning itself as a significant hub for strategic influence and

innovation in the

evolving landscape of EV transition. The country aims to further integrate itself into global value chains and

bolster its standing as a leader in sustainable industrial development. However, the electric vehicle production

in the country as of 2024 is in the infancy stage.

The country currently produces between 40,000 and 50,000

electric vehicles per year, including the Fiat Topolino, Opel E-Rocks, and Citroën Ami mini-EVs. However,

Morocco’s electric vehicle production capacity is expected to increase to around 100,000 units by 2025. By 2030,

electric vehicles produced in Morocco are expected to account for up to 60 percent of all cars exported, according

to the Ministry of Industry and Trade.

Investments in Morocco for the EV & its Value Chain

Morocco is emerging as a key hub for Chinese companies eager to lead the charge in e-mobility. Through strategic partnerships, the country is laying the groundwork for a robust electric vehicle industry and supply chain, paving the way for a sustainable, tech-driven automotive future. With $10.5 billion in investments backing these agreements, Morocco is accelerating toward a greener, smarter future on the road.

Morocco's strategic location at the crossroads of Europe, Africa, and the United States

uniquely positions it to

capitalize on opportunities in the electric vehicle (EV) industry. Nestled between the EU and Africa, the country

can efficiently access both markets. The short 14-kilometer distance between Morocco and Europe, via the Strait of

Gibraltar, provides seamless supply chain logistics, advanced technologies, research, and a ready consumer base.

Meanwhile, its connection to Africa presents exciting opportunities for market expansion in a continent with

growing demand for electric vehicles.

The port of Tanger Med, Africa's largest port, located 45 km northeast of

Tangier and opposite Spain, enhances Morocco's strategic advantage, serving as a vital trade gateway. This boosts

Morocco’s role as a prime investment destination and a key hub for the production, innovation, and export of EVs

and related technologies.

Morocco's venture into electro-mobility is not a solo journey but one built on strong strategic partnerships with leading global industry players, including China. These collaborations aim to develop a solid foundation for the electric automotive industry and its supply chain, driving a future that is both sustainable and technologically advanced. A landmark achievement in this regard is the agreement to establish Africa's first Gigafactory by Gotion High-Tech Co., Ltd. This investment, signed on June 6, 2024, marks a significant milestone in Morocco's role in shaping the future of the EV industry.

WHAT ROADBLOCKS MOROCCO SHOULD OVERCOME ?

To Evolve as a Global Export Hub for EV/EV supply chain

- Addressing regulatory hurdles, establishing clear guidelines for EV deployment

- Fasten deployment of EV charging infrastructure. Morocco targets 2500 EV charging stations across the country by 2026

- Focusing on affordability & accessibility of EVs to the masses

- Investing in indigenous battery manufacturing capabilities and fostering partnerships with global leaders in battery technology bolster Morocco's position in the electro-mobility landscape

- Increase in public awareness & perception: Effective public outreach campaigns, education initiatives, and demonstrations highlighting the benefits of electro-mobility are essential in shifting perceptions and fostering a culture of sustainability and innovation.

-

Boost to Digital Infrastructure and Business Models:

Aligned with smart city strategies, leverage digital

technologies to establish a connected and intelligent transportation network, enhancing the efficiency and

safety of EVs