India’s datacentre boom: Policy tailwinds, 5G, and cloud growth to power US$ 30 Billion investments by 2030

Why is India’s digital infrastructure entering a new “gold rush,” positioning datacentres as the most compelling high-conviction opportunity? Unlock the Opportunity with Eninrac’s Report India Datacentre Market Outlook: A Strategic Perspective to 2030

India’s datacenter industry is entering a sustained structural growth trajectory, driven by progressive

policy reforms, rapid 5G proliferation, and accelerated cloud adoption. Between 2024 and 2030, anticipated

investments of USD 10–12 billion are set to fundamentally reshape the ecosystem—spanning IT hardware, power

infrastructure, advanced cooling systems, and large-scale construction.

Growth will continue to

cluster

around Mumbai, NCR, Hyderabad, and Chennai, which are emerging as the country’s core hyperscale hubs.

Parallelly, edge datacenter deployments will scale to enable latency-sensitive use cases across telecom,

automotive, and urban infrastructure. Sustainability is becoming a decisive procurement criterion, with

renewable energy sourcing and high-efficiency cooling architectures evolving from differentiators to

baseline expectations. The industry value chain is also shifting toward software-driven and service-led

operating models, unlocking higher-margin, recurring revenue pools.

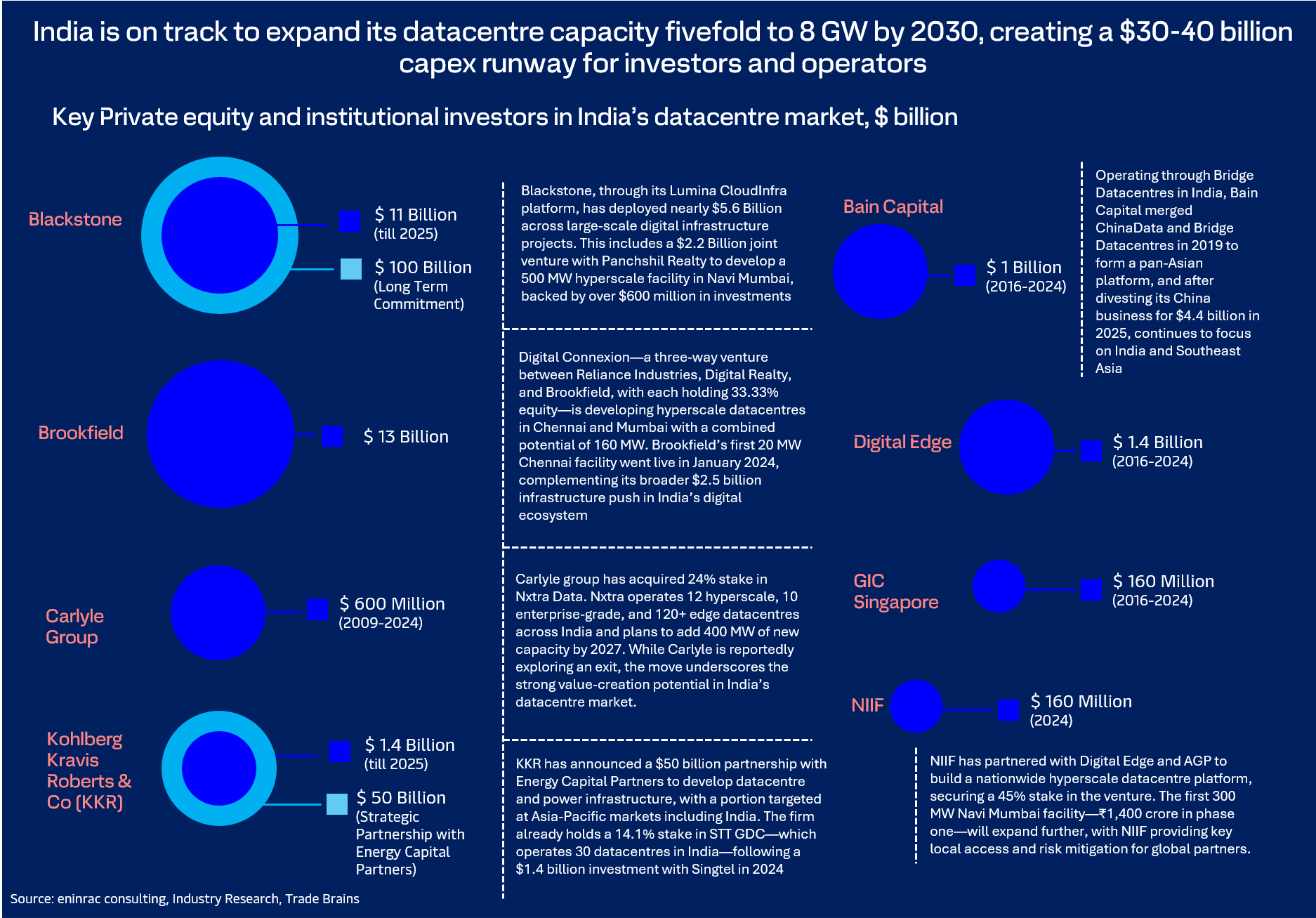

Against this backdrop, global private equity investors are sharply increasing their commitments to India’s digital infrastructure sector, attracted by resilient, data-linked returns and the nation’s aspiration to build a USD 1 trillion digital economy by 2030. Capital deployment is intensifying across edge facilities, AI-ready hyperscale campuses, and scalable fibre networks. Since 2020, more than USD 15 billion has already been committed and deployed, with a further USD 20–25 billion expected by decade-end. This momentum positions India as one of the fastest-growing and most strategically significant digital infrastructure markets globally.

India attracted investment commitment of approx. $ 60.3 billion from both domestic and international investors between 2019-2024

Underlying Opportunity in India’s datacentre market space, $ Billion (B)

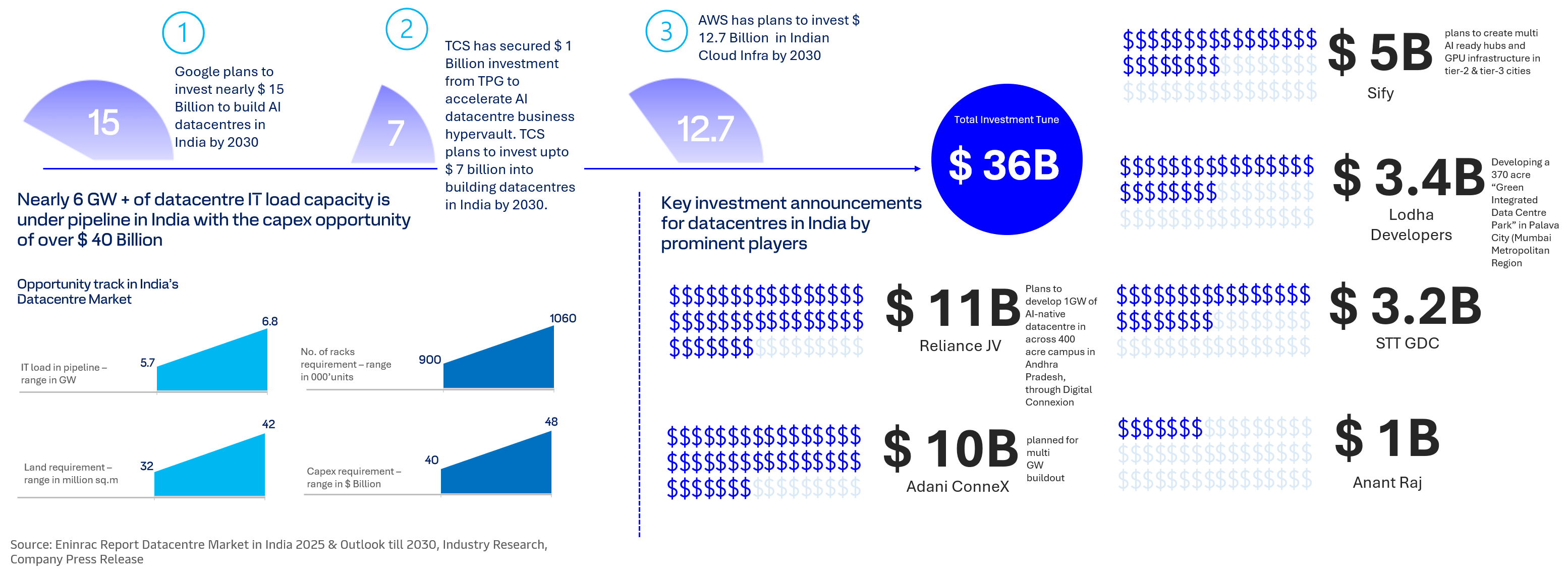

Investment plans rolled out by Google, Tata & AWS in India for datacentre expansion by 2030

The Opportunity Breakup

To contextualize the estimated $20-25 billion investment requirement for the datacentres, it is important to

note that this figure likely understates the full capital outlay. The estimate captures investment from only

three of the five compute-power investor archetypes—builders, energizers, and technology

developers/designers—who directly fund the underlying infrastructure and foundational technologies enabling

datacentres at scale. Roughly 15% (~$3.3 billion) of the investment is expected to flow to builders for land

acquisition, materials, and site development.

Another 25% (~$5.6 billion) will be directed toward

energizers for power generation, transmission, cooling, and electrical systems. The largest share—60%

(~$13.5

billion)—will go to technology developers and designers responsible for advanced chips and compute

hardware.

The remaining two archetypes—operators (hyperscalers and colocation providers) and AI architects (AI model

and application developers)—also materially invest in compute capacity. However, isolating their

infrastructure spending is complex in the Indian context, as much of it is embedded within broader R&D,

software, and platform-development budgets. This framework is increasingly relevant for India as it

accelerates AI-ready datacentre capacity, grid modernization, and semiconductor-linked capital formation.

India preferred as a reshoring hub for datacenter development & scaling – What’s driving the rush ?

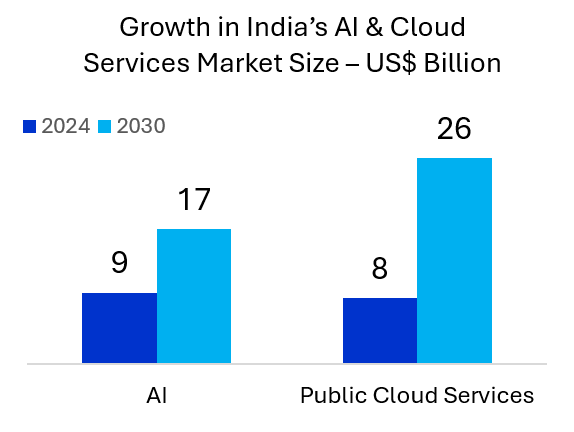

Increase in AI Adoption

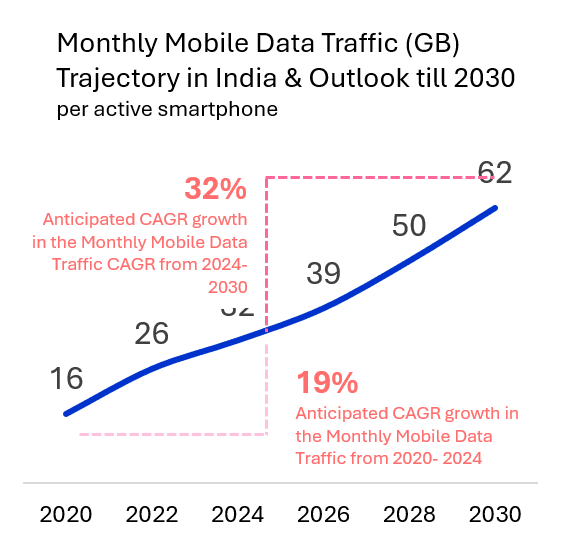

Rising Data Demand

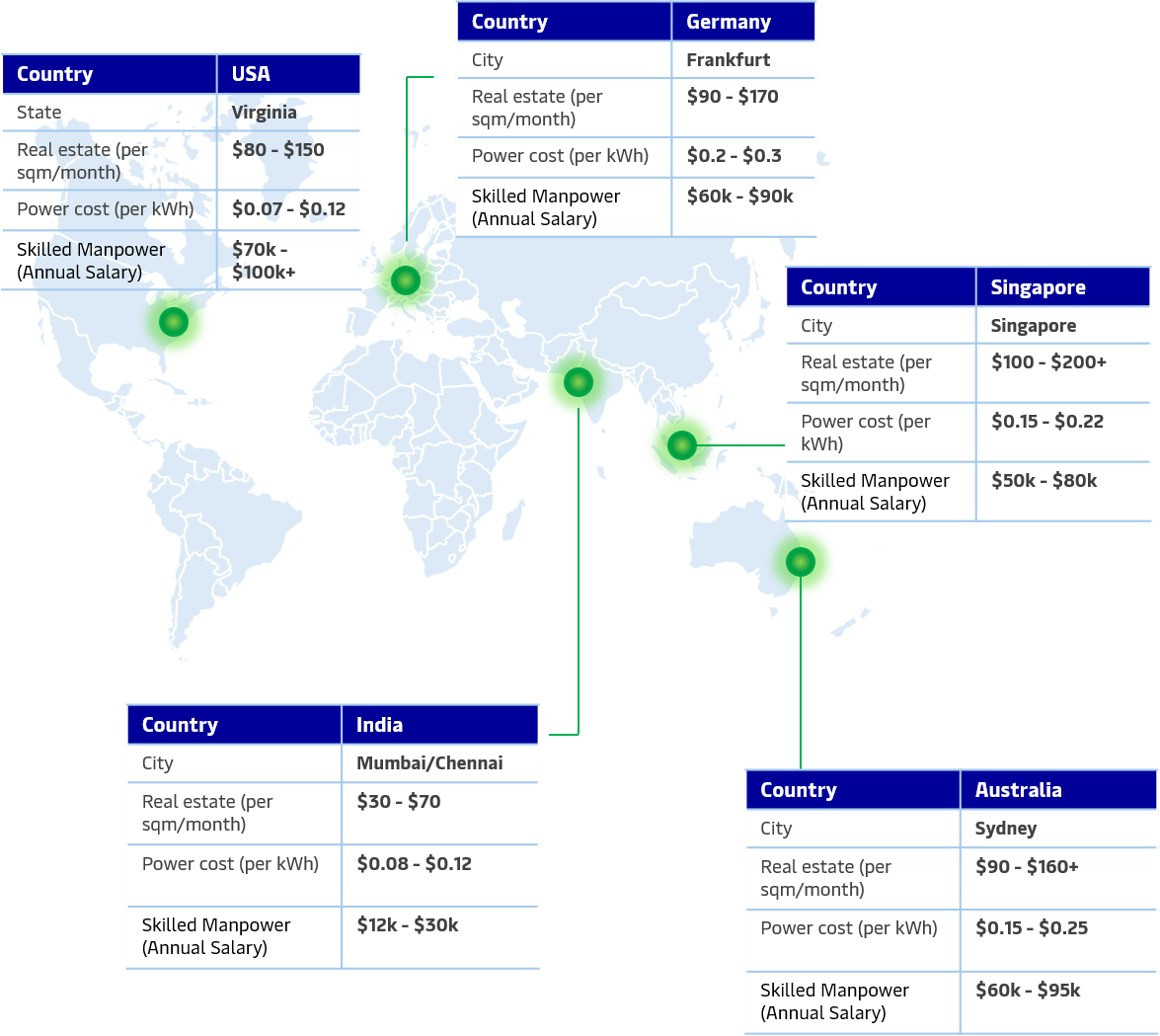

Cost Competitiveness

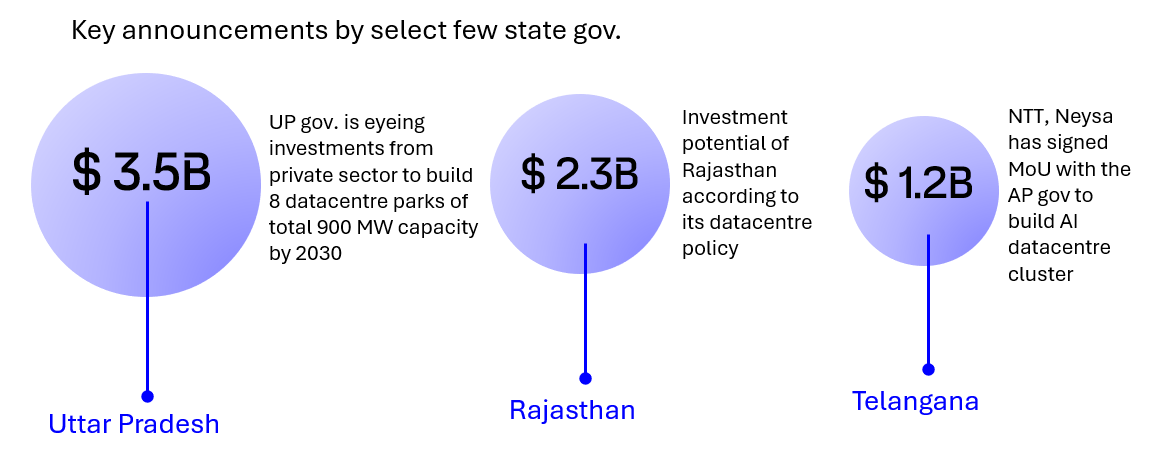

State Level Investment Centric Support

Network and international connectivity

India has the potential to become a dominant player in the global submarine cable network due to its strategic geographical location. The country currently hosts around 17 international subsea cables across 14 landing stations located in Mumbai, Cochin, Tuticorin, Chennai, and Trivandrum. As of the end of 2022, the total lit capacity and activated capacity of these cables stood at 138.606 Tbps and 111.111 Tbps, respectively.

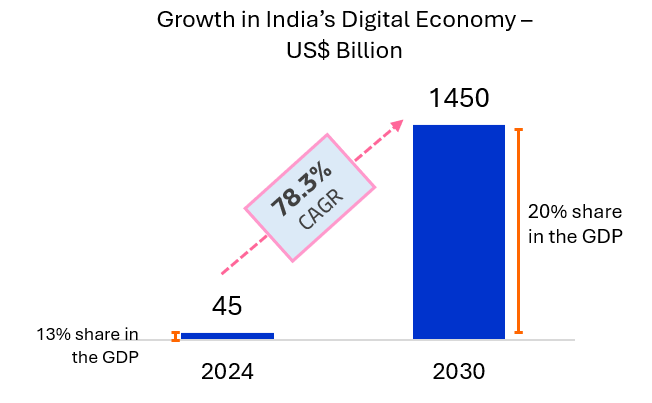

Growth in India’s Digital Economy

By 2030, India’s digital economy is projected to contribute nearly 1/5th of the nation’s overall GDP. India is on the track to become the world’s third largest economy with a projected GDP of US$ 7.3 Trillion by 2030 (as per S&P) and the share of digital economy would around US$ 1.46 Trillion.

Source: Eninrac Report Datacentre Market in India 2025 & Outlook till 2030, Industry Research

Key Signpost –Why Datacentres Will Be India’s Digital Infrastructure Backbone ?

Datacentres are emerging as the core enabler of India’s digital transformation, anchoring the nation’s ambitions across 5G, AI, cloud computing, and Industry 4.0. Their expansion is set to drive USD 20-25 billion in investments by 2030, creating a resilient foundation for data sovereignty, service reliability, and low-carbon digital infrastructure. Development of datacentres would offer significant opportunities for the entire spectrum of the value chain, which can be seen below-

For Power & Utilities

Datacentre growth will catalyze demand for reliable, high-quality power infrastructure, driving investments in renewables integration, grid stability, and captive energy solutions — positioning utilities as strategic enablers of digital infrastructure

For OEMs & Equipment Suppliers

Accelerated capacity additions will expand opportunities for cooling systems, UPS, transformers, switchgear, and IT hardware, fostering local manufacturing and technology partnerships under the Make-in-India framework

For ICT & Network Providers

Datacentres will act as hubs for edge computing and 5G backhaul, creating synergies for fiber expansion, network densification, and digital connectivity upgrades nationwide.

For Real Estate & Infra Developers

The sector will unlock a new asset class in industrial-grade digital real estate, spurring land development, urban zoning reforms, and green building innovations across key metro and emerging Tier-II clusters.

For Construction & EPC Partners

EPC firms will benefit from integrated design–build contracts covering civil, MEP, HVAC, and electrical works, driving specialized engineering capabilities and cross-sector project management efficiencies