COMPETITIVE ANALYSIS OF INDIA’S GREEN HYDROGEN PRICING: IMPLICATIONS OF L&T’s ₹397/kg BID FOR IOCLs

Competitiveness of Green Hydrogen Prices: India vs Global Benchmarks

- Focused Scope: Analyzes a real-world bid (L&T’s ₹397/kg) as a case study.

- Relevance: Ties India’s green hydrogen ambitions to global benchmarks.

- Actionable Insights: Covers pricing, policy, risks, and industrial implications.

- Data-Driven: Built on validated datasets

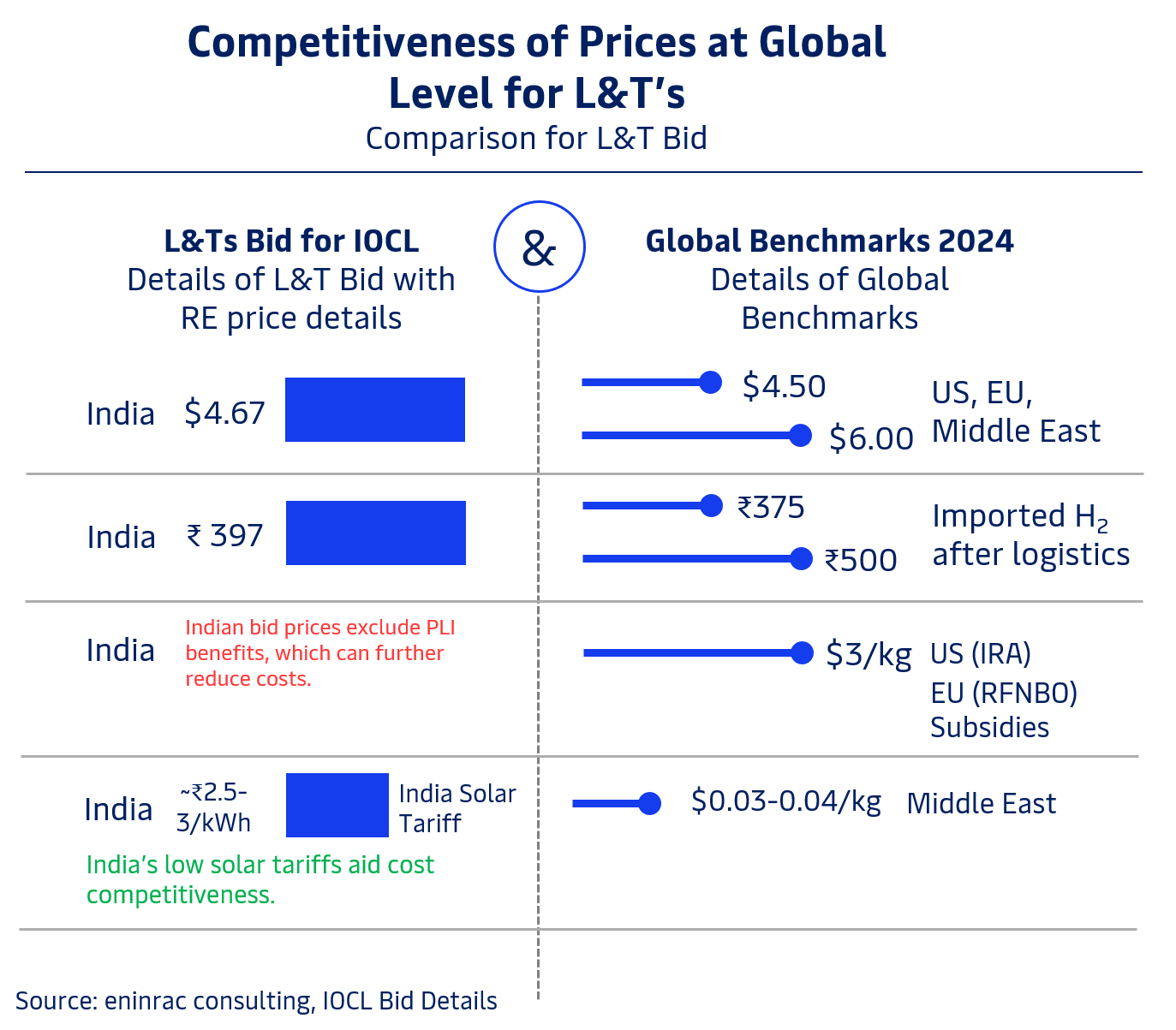

India, led by players like L&T Energy Green Tech, is emerging as a competitive hub for green hydrogen production. With a price of $4.67/kg (₹397/kg), L&T’s hydrogen offering is already aligned with global low-cost producers such as Saudi Arabia and the UAE, whose prices range between $4.50–$6.00/kg.

When factoring in logistics and import costs, Indian green hydrogen is cheaper than most EU-imported hydrogen, which lands at ₹500–600/kg. This cost advantage is further reinforced by India’s ultra-low solar tariffs (₹2.5–3/kWh), among the lowest globally, which significantly reduce the cost of electrolysis-based hydrogen production.

Notably, L&T's bid prices exclude government incentives under the SIGHT Scheme or PLI benefits, indicating room for even lower prices once policy support is fully leveraged. While global peers benefit from aggressive subsidies like the US IRA ($3/kg) and EU RFNBO subsidies, India's cost base is largely driven by natural competitiveness in renewable energy. This positions India and L&T specifically as a strong contender in the global green hydrogen value chain, with potential to serve both domestic industrial demand and export markets.

L&T’s $4.67/kg green hydrogen bid is globally competitive lower than EU imports and close to Middle East prices. With India’s low solar costs and excluded subsidies, prices could drop further, boosting India’s export potential.

Offtake Agreements: Anchoring Price Discovery for India’s Green Hydrogen Future

Offtake agreements are proving vital for stabilizing and scaling India’s green hydrogen market. The Panipat project’s 25-year offtake deal at ₹397/kg with IOCL not only secures price certainty but enhances project bankability setting a credible pricing benchmark for future bids. With scale-driven efficiencies and larger capacities on the horizon, prices may fall below ₹350/kg. Comparable to global models like Saudi Arabia’s NEOM, such contracts could help India emerge as a competitive green hydrogen exporter, provided logistical hurdles are effectively managed.

| Aspect | Impact on Panipat Project | Future Implications |

|---|---|---|

| Price Stability | Fixed ₹397/kg for 25 years reduces volatility | Sets a benchmark for future bids (likely ₹380–420/kg range) |

| Bankability | Guaranteed offtake by IOCL improves project financing. | Encourages more BOO models in India (e.g., GAIL, NTPC tenders) |

| Scale Effect | 10,000 TPA allows economies of scale. | Larger future projects (e.g., 100,000 TPA) could drive prices below ₹350/kg. |

| Global Contracts | Comparable to Saudi NEOM ($4.50/kg, 25-year offtake). | Indian prices may attract global demand if logistics costs are managed. |

Realistic Implications of India’s Green Hydrogen Push: A Phased Perspective

India’s green hydrogen rollout is poised to deliver tangible impacts

in both the short and long term. Between 2024 and 2027, early

industrial adopters, particularly in refineries and fertilizer

production will drive initial demand. This foundational uptake will

be critical for de-risking investments,

with $2–3 billion expected to flow into domestic electrolyzer

manufacturing.

By 2030, deeper decarbonization in hard-to-abate sectors like steel

and transport will take shape, positioning

India to capture 5–10% of the global electrolyzer market.

On the socio-economic front, each 100,000 TPA project could generate

around 5,000 jobs, providing a significant boost to engineering and

O&M sectors.

Environmentally, a single project like Panipat could cut 1

million tonnes of CO₂ annually.

If India scales to 5 million tonnes of green hydrogen by 2030, it

will make a substantial contribution toward meeting its NDC targets

marking green hydrogen as both a climate and industrial

transformation enabler.

| Implication Area | Short-term (2024–2027) | Long-term (2030+) |

|---|---|---|

| Industry Adoption | Refineries, fertilizers to adopt green H2 first. | Steel, transport sectors to follow. We might see similar tenders from these sectors. |

| Investment Flow | $2–$3B expected in Indian electrolyzer manufacturing. | India could capture 5%–10% of global electrolyzer market. |

| Job Creation | ~5,000 direct/indirect jobs per 100,000 TPA capacity. | Skilled workforce demand in engineering and O&M. |

| Emissions Reductions | ~1 MT CO2/year saved at Panipat. | NDC targets achievable if 5 MT capacity is built by 2030. |

Low Price Discovery in India’s Green Hydrogen Market: Key Structural Challenges

For a deeper dive into the role of advanced materials in hydrogen storage and transport, and how India can unlock its strategic role in a $200B global market, explore this detailed report.

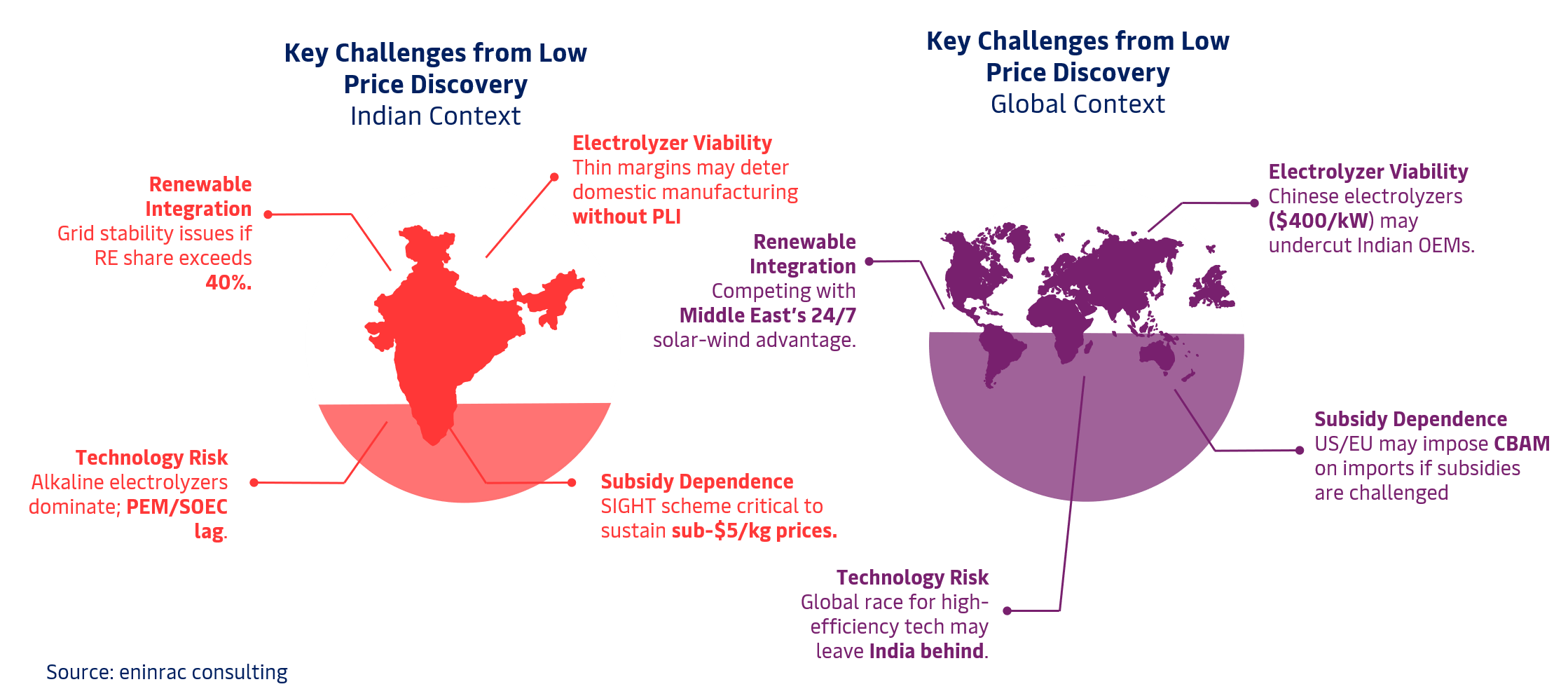

While India’s recent green hydrogen bids signal strong global competitiveness, the aggressive price discovery below $5/kg raises several structural challenges that could impact long-term market sustainability. These challenges are enlisted as below:

-

Electrolyzer Viability remains a pressing concern. With bid margins already tight, domestic manufacturers may find it unviable to scale without Production Linked Incentives (PLI). Compounding this is the influx of ultra-low-cost Chinese electrolyzers priced at ~$400/kW, which threaten to undercut Indian OEMs and stall local capacity development.

-

Renewable Energy Integration poses technical constraints. As green hydrogen production scales, India's grid could face stability issues if renewable energy penetration surpasses 40%, especially without adequate storage and smart grid solutions. Meanwhile, competitors like the Middle East benefit from near-continuous solar-wind availability, reducing intermittency costs.

-

Subsidy Dependence is another area of vulnerability. The viability of current low prices hinges heavily on schemes like SIGHT. Should globally trade policies like the EU’s Carbon Border Adjustment Mechanism (CBAM)—scrutinize subsidy-backed exports, India may face restricted market access or increased tariffs.

-

Technology Risk looms large. India's market is still dominated by alkaline electrolyzers, while advanced technologies like PEM and SOEC remain underdeveloped domestically. As global players invest in next-gen, high-efficiency systems, India risks falling behind unless R&D and commercialization efforts are rapidly accelerated.

In sum, while India’s price competitiveness is commendable, a balanced strategy is essential, one that supports innovation, ensures fair margins, and fortifies grid and industrial readiness to deliver a resilient green hydrogen ecosystem.